Kraken Review 2024

Kraken was founded by Jesse Powell in 2011 in San Francisco. Kraken launched officially in 2013 after testing and development. Since that time, the exchange has been one of the most demanded platforms for trading digital assets. Around 2.5 million investors visit Kraken daily.

In 2014, the exchange was included in the Bloomberg Terminal along with Coinbase. Kraken is accredited in the U.S., Canada, UK, Australia and Japan. As of 2022, the exchange is available to residents of 180 countries. Transactions with 116 coins and 500 trading pairs are executed on the platform.

Kraken benefits include quick and responsible customer support and a knowledge database for beginners. The drawback of the exchange is mandatory verification for trading.

Kraken rating

The exchange is among the Top 5 largest platforms in terms of daily trading volume and traffic.

| Total score | 8.5 |

|---|---|

Commissions

Commissions

|

9 |

Security and regulation

Security and regulation

|

9 |

Markets

Markets

|

8 |

Passive income

Passive income

|

8 |

Account opening

Account opening

|

7 |

Deposit and withdrawal

Deposit and withdrawal

|

9 |

Trading platforms

Trading platforms

|

10 |

Analytics

Analytics

|

7 |

Education

Education

|

8 |

Customer support

Customer support

|

10 |

Bonuses

Bonuses

|

8 |

Kraken Pros and Cons

Kraken has some strong advantages, but also clear disadvantages. This is typical of all cryptocurrency exchanges, because their assessment is always subjective. What one investor considers inconvenient for trading, another investor will call perfect conditions.

Basic information

The exchange was established in 2011. Over a decade of operation, it has gained a wide user base. Daily trading volumes at Kraken reach $850 million. More details about the cryptocurrency exchange are available in the table below.

| Name | Kraken |

|---|---|

| Website | www.kraken.com |

| Exchange type | Centralized |

| Regulation | FinCEN |

| Taker’s fee | from 0.12 to 0.26 % |

| Maker’s fee | from 0.02% to 0.16% |

| Demo account | No |

| Minimum deposit | Depends on account type |

| BTC withdrawal limits |

Per day – from $5,000 to $10,000,000 (depending on the verification level). Per month – no limits. |

| Time frame for account opening | from 10 minutes (for account registration) to 5 days (for verification) |

| Leverage | Up to 1:5 |

| Markets | 424 |

| Passive income options | On-chain staking / off-chain staking |

| Withdrawal fee | Transfer fee: 0.9% / for any stablecoins and currency pairs / 1.5 % / for other cryptocurrencies / 3.75 % / + €0.25 for debit/credit cards / 1.7 % / + $0.10 for online banking |

| Deposit methods |

Sepa, bank transfer, cryptocurrencies, debit/credit card (Visa/MC) |

| Withdrawal methods |

Sepa, bank transfer, cryptocurrencies, debit/credit card (Visa/MC) |

| Account currencies | List of currencies (for example BTC, ETH, USD, EUR) |

Kraken commissions and fees

The fees depend on the 30-day trading volume of an investor. The fee for purchasing stablecoins (USDT, USDC or DAI) with USD or purchasing them with another stablecoin is 0.9%. There is a 1.5% fee for purchasing stablecoins with another cryptocurrency, for example BTC. The higher the 30-day trading volume the lower are the fees. Here are some other specifics of paying fees on Kraken:

- The fees are charged for each separate transaction.

- The fee amount depends exclusively on the 30-day trading volume.

- Clients get discounts upon achieving a certain trading volume.

Trading fees

Kraken uses maker-taker fees with a system of incentivizing high trading volumes. The fees are charged based on the 30-day trading volume of a trader.

| 30-day volume | Maker’s fee | Taker’s fee |

|---|---|---|

| $0 — $50'000 | 0.16% | 0.26% |

| $50'001 — $100'000 | 0.14% | 0.24% |

| $100'001 — $250'000 | 0.12% | 0.22% |

| $250'001 — $500'000 | 0.10% | 0.20% |

| $500'001 — $1'000'000 | 0.08% | 0.18% |

| $1'000'000 —$2'500'000 | 0.06% | 0.16% |

| $2'500'001 — $5'000'000 | 0.04% | 0.14% |

| $5'000'001 — $10'000'000 | 0.02% | 0.12% |

For trading FX pairs (EUR and USD), where stablecoin acts as the base currency (USDT/USD, DAI/USDT), the following fee schedule is applied:

| 30-Day Volume (USD) | Maker’s fee | Taker’s fee |

|---|---|---|

| $0 — $50'000 | 0.20% | 0.20% |

| $50'001 — $100'000 | 0.16% | 0.16% |

| $100'001 $ — $250'000 | 0.12% | 0.12% |

| $250'001 — $500'000 | 0.08% | 0.08% |

| $500'001 — $1'000'000 | 0.04% | 0.04% |

| $1'000'000+ | 0.00% | 0.00% |

Futures trading is provided by Kraken Futures fee schedule, offering incentives for high trading volumes similar to FX pairs, spot with stablecoins.

| 30-Day Volume | Maker’s fee | Taker’s fee |

|---|---|---|

| 0 – $100'000 | 0.0200% | 0.0500% |

| $100'000 – $1'000'000 | 0.0150% | 0.0400% |

| $1'000'000 – $5'000'000 | 0.0125% | 0.0300% |

| $5'000'000 – $10'000'000 | 0.0100% | 0.0250% |

| $10'000'000 – $20'000'000 | 0.0075% | 0.0200% |

| $20'000'000 – $50'000'000 | 0.0050% | 0.0150% |

| $50'000'000 – $100'000'000 | 0.0025% | 0.0125% |

| $100'000'000+ | 0.0000% | 0.0100% |

Non-trading fees

The exchange does not charge a fee on deposits in cryptocurrency. The situation, however, is reverse for fiat money. In this case, the fee depends on the deposit/withdrawal method:

| Withdrawal | Withdrawal minimum | Fee | Processing time |

|---|---|---|---|

| SWIFT (Bank Frick) | 4 USD | 3 USD | Up to 5 business days |

| SWIFT (Etana Custody) | 150 USD | free | Up to 5 business days, sometimes instant |

Average fee compared to competitors

| Trade | Kraken | Binance | HTX (Huobi) |

|---|---|---|---|

| Taker | 0.15% | 0.06% | 0.09% |

| Maker | 0.06% | 0.05% | 0.08% |

The fees at Kraken cannot be considered high; they are rather average. HTX (Huobi), for example, charges higher fees, but the fees of Binance are lower. At that, Kraken promises zero fees for investors with a volume of over $1,000,000. Neither Binance nor HTX (Huobi) offer this option.

Margin lending

For opening or closing a margin position, all fees for using the margin are added to the trading fees. The clients who opened an account outside of the U.S. can hold an open margin position for up to 365 days.

| Currency | Quote currency | Opening fee | Rollover fee |

|---|---|---|---|

| ADA (Cardano) | EUR, USD, ETH, BTC | 0.02% | 0.02% (per 4 hours) |

| ALGO (Algorand) | EUR, USD, BTC | 0.02% | 0.02% (per 4 hours) |

| BCH (Bitcoin Cash) | EUR, USD, BTC | 0.02% | 0.02% (per 4 hours) |

| BTC (Bitcoin) | EUR, USD | 0.01% | 0.01% (per 4 hours) |

| BTC (Bitcoin) | GBP, CAD, USDT | 0.02% | 0.02% (per 4 hours) |

| DASH (Dash) | EUR, USD, BTC | 0.02% | 0.02% (per 4 hours) |

| DOT (Polkadot) | ETH, EUR, USD, BTC | 0.02% | 0.02% (per 4 hours) |

Reliability and regulation

Jesse Powell is the founder and CEO of the company. Payward, Inc. is the owner of the cryptocurrency exchange. It is registered in San Francisco. The security system has never let down in the entire period of its operation. At least there have been no reports in the media about any major hacker attacks on the user accounts.

Investor funds are held in cold wallets. Traders can turn on two-factor authentication, if they fear for the security of their account. There is a team of experts at the exchange tasked with testing the security system.

Kraken holds an official license for trading crypto futures. The exchange complies with all the rules of AML and KYC. The Financial Conduct Authority (FCA) is responsible for licensing the crypto exchange. Kraken is regulated by FinCEN. The funds of crypto exchange clients are held in strictly regulated partner banks, directly in the bank accounts of the clients themselves. Kraken Bank is regulated by the Wyoming State Banking Branch.

Kraken plans to go public in 2022. The exchange is considering a direct listing over IPO. This is an additional factor that plays into the hands of Kraken, as it will significantly increase the transparency of the company and make it accountable to the SEC.

Markets and products

The exchange offers access to trading 424 currency pairs, 116 digital currencies (including Tether, which is traded with the US dollar) and 7 fiat currencies, including:

- USD (US Dollar)

- EUR (Euro)

- CAD (Canadian Dollar)

- AUD (Australian Dollar)

- GBP (Pound Sterling)

- CHF (Swiss Franc)

- JPY (Japanese Yen)

Pros and cons of market diversity on Kraken

Kraken markets

| Kraken | HTX (Huobi) | Binance | |

|---|---|---|---|

| Cryptocurrencies* | 195 | 584 | 584 |

| Trading pairs* | 598 | 1135 | 1594 |

| Bitcoin | Yes | Yes | Yes |

| Ethereum | Yes | Yes | Yes |

| Altcoins | Yes | Yes | Yes |

| Futures and options | Yes | Yes | Yes |

| Cryptocurrency funds (a basket of cryptocurrencies in one lot) | No | No | No |

| NFT | No | Yes | Yes |

Cryptocurrencies (spot)

The exchange offers 116 digital coins that form 418 trading pairs. The following are traded here: Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Tether (USDT) and Polkadot (DOT). The supported traditional currencies include USD, EUR, GBP, CAD, JPY, CHF and AUD.

Cryptocurrencies (Futures)

Kraken allows traders to concluded cryptocurrency futures contracts:

- Ethereum

- Litecoin

- Bitcoin Cash

- Ripple and others

Kraken allows users to open positions on cryptocurrency futures with a leverage up to 50:1. Collateral in this case is 2% of the conditional volume of trade.

Passive income on Kraken

The exchange offers off-chain and on-chain staking for earning passive income. On-chain staking uses Proof-of-Stake blockchain mechanism for receiving the reward.

Benefits of on-chain staking on Kraken compared to staking on other platforms:

- Instant reward – without the waiting or tie-up periods;

- Payouts twice a week;

- One of the highest profitability rates in the industry;

- Assets can be staked in just three clicks from your Kraken account balance;

- Instant unstaking.

| Currency | Rewards per year (RPY) | Stake/unstake minimum | Reward schedule |

|---|---|---|---|

| Algorand (ALGO) | 4.75% | 0.000001 ALGO | Thursday Starting at 01:30 UTC |

| Cardano (ADA) | 4%-6% | 0.000001 ADA | Monday Starting at 01:30 UTC |

| Cosmos (ATOM) | 7.5% | 0.000001 ATOM | Sunday and Wednesday Starting at 01:00 UTC |

| Ethereum | 4%-7% | 0.0000000001 ETH | Sunday Starting at 01:30 UTC |

| Flow (FLOW) | 6%-9% | 0.00000001 FLOW | Tuesday Starting at 01:30 UTC |

The rates for off-chain staking are available in the US dollar, Euro and Bitcoin.

| Asset | Rewards per year (RPY) | Stake/unstake minimum |

|---|---|---|

| Bitcoin (BTC) | 0.25% | 0.00000001 BTC |

| US Dollar (USD) | 2% | USD 0.01 |

| Euro (EUR) | 1.5% | EUR 0.01 |

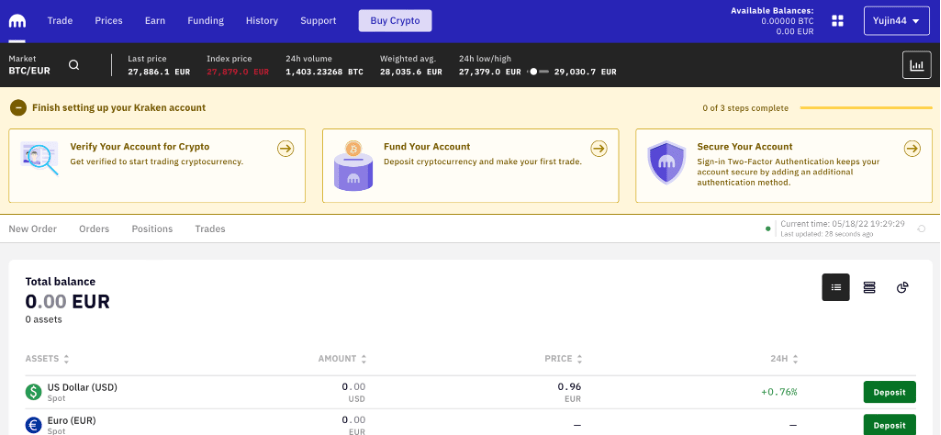

Account opening on Kraken

User account registration procedure takes about 10 minutes. There is, however, one condition, which many users consider the biggest drawback of the exchange. Simple registration will not allow users to start trading; for that they have to pass verification. The majority of cryptocurrency exchanges require identity verification for access to additional financial instruments or assets. Meanwhile, Kraken obliges every new user to pass verification.

Account opening on Kraken

Residents of which countries can trade at the exchange

The website of the exchange claims it supports clients from all around the world. Residents of some countries cannot trade on Kraken due to international or local financial and cryptocurrency regulations. The cryptocurrency exchange provides the list of countries, the residents of which can trade at the exchange. For more information follow this link. There are no mentions of the regions where Kraken does not operate.

How to open an account on Kraken:

a step-by-step guide

There are several steps in the registration procedure on the website:

Open the official website of Kraken and select your language in the right corner at the bottom of the page.

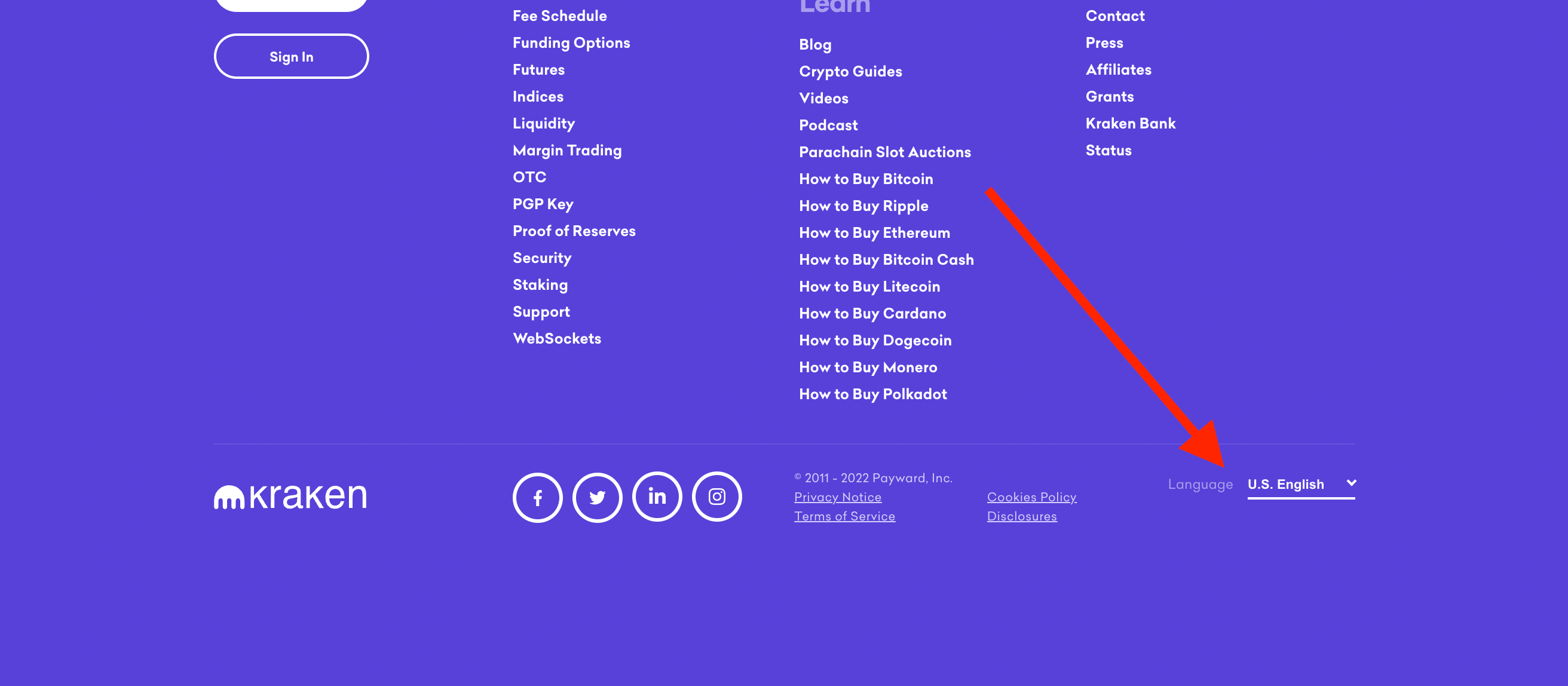

After you’ve changed the language, click Create Account in the top right corner, which opens the “Create Your Account” tab.

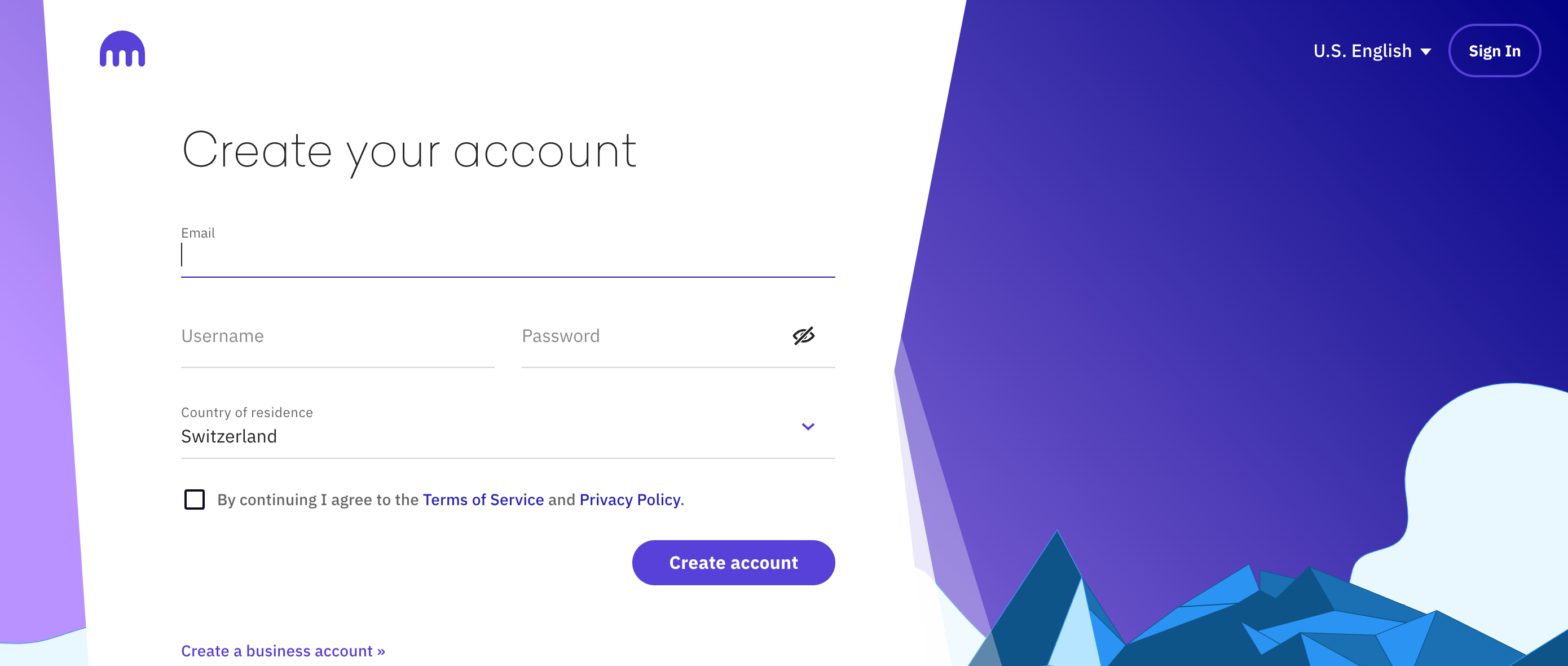

Fill out the questions, specify your email, come up with the username and password, tap the box to confirm that you agree to the Terms of Service and Privacy Policy. The activation code will be sent to your email.

Enter the activation code and click Activate Account to complete registration.

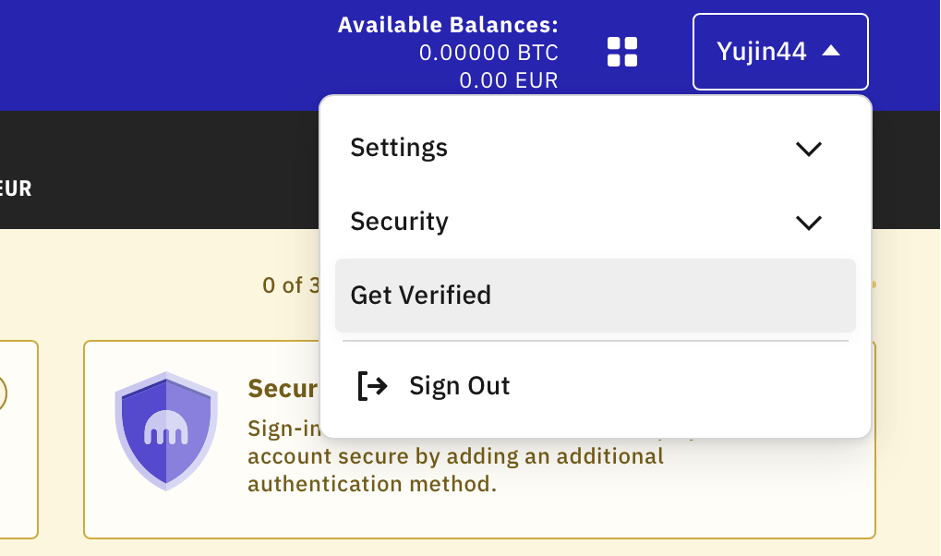

Now, let’s take a closer look at the verification procedure. By this time, a user already has a registered account. Here are the steps of the verification:

Step 1. In the top right corner of the profile, click on the username button.

Step 2. In the pop-down menu, select the third option Get Verified.

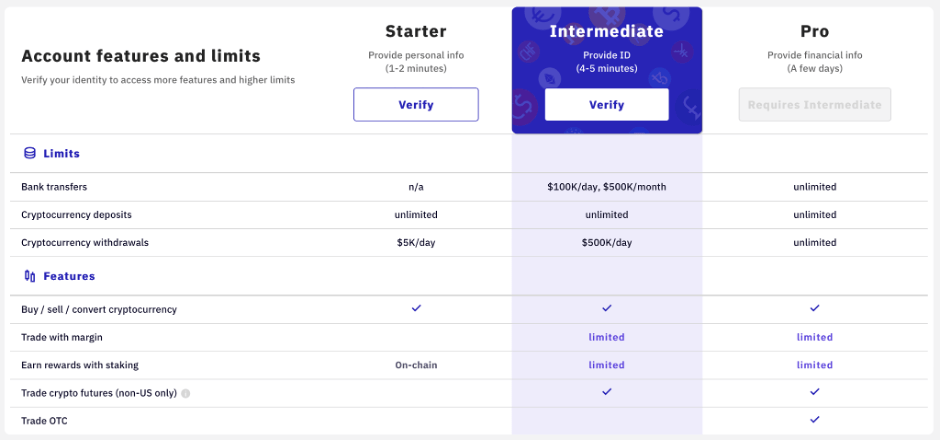

Step 3. A page will open, where you will need to choose the verification type. Each type has specific limits, transfers and deposit options.

User verification requires proof of identity.

The documents that are acceptable:

- passport;

- driver’s license;

- national identity card;

- other valid government-issued documents with full legal name, date of birth, photo, issue and expiry dates.

Next, you need to provide your Proof of Residence document, for example:

- Bank statement;

- Credit card statement;

- Residence certificate;

- Utility bill (water, electricity, gas, internet, phone);

- Payroll statement -or- Official salary document from employer;

- Insurance statement;

- Tax document;

If a client of the exchange is a U.S. citizen, he will be required to provide a photo and a valid SSN (social security number) or ITIN (individual taxpayer identification number).

For each verification level, there is a specific time frame.

| Level | Approximate verification time frame | Type of verification |

|---|---|---|

| Express | Less than one minute | Automatic |

| Starter | 1-2 minutes | Automatic |

| Intermediate | 4-5 minutes | Automatic |

| Pro - Individual | Several days | Non-Automatic |

| Pro - Business | 5 days | Non-Automatic |

Minimum deposit

Deposits in cryptocurrency are credited within 10 minutes and they are not charged with a fee. The minimum deposit depends on the cryptocurrency a user is funding his account with. More details on the minimum deposit for different digital assets are available here.

Deposits in fiat are charged with a fee. The table below shows the details on the minimum deposit in US dollars.

| Deposit method | Deposit minimum | Deposit fee | Processing time |

|---|---|---|---|

| SWIFT (Bank Frick) |

$4 | $3 | 1-5 business days |

| SWIFT (Etana Custody) |

$150 | free | Instant or 2-5 business days |

Account types

A user can open one of 3 account types. For each type, there are individual deposit and withdrawal limits. Verification procedure for each type is also different. Registration of Intermediate and Pro accounts requires provision of additional information about the person on top of the proof of identity.

| Deposit limit | Withdrawal limit | Other Features | |

|---|---|---|---|

| Starter Account | Unlimited deposit in cryptocurrency. Deposit in fiat is not available. |

Withdrawal in cryptocurrency – $ 5,000 per day. Withdrawal in fiat – not available |

-- |

| Intermediate Account | Unlimited deposit in cryptocurrency. Deposit in fiat - $100,000 per day. |

Withdrawal in cryptocurrency – $500,000 per day. Withdrawal in fiat - $100,000 per day. |

A photo and occupation information is required for verification |

| Pro Account | Unlimited deposit in cryptocurrency. Deposit in fiat - 10M per day. |

Withdrawal in cryptocurrency – $10M per day. Withdrawal in fiat - $10M per day. |

Verification of financial reporting and AML. |

Deposit and withdrawal

You can fund your account using cryptocurrency or fiat money. The fee depends on the deposit method. The exchange supports the following fiat currencies:

- USD (US Dollar)

- EUR (Euro)

- CAD (Canadian Dollar)

- AUD (Australian Dollar)

- GBP (Pound Sterling)

- CHF (Swiss Franc)

- JPY (Japanese Yen)

Popular digital coins, such as:

- Ethereum;

- Bitcoin;

- Dash;

- Litecoin;

- Ripple.

As well as assets that have just gained recognition:

- Iconomi;

- Augur.

Crypto coins are credited to the accounts very fast; within 10 minutes, which cannot be said about fiat currencies. Processing of such deposits can take 1 to 5 days. In the majority of cases, the money is credited within 24 hours, but sometimes it takes longer.

Deposit and withdrawal options and processing time on Kraken

The exchange uses a complex system for charging deposit fees. The fee depends on the volume of the currency that is being credited to the account, deposit method and currency availability.

| Method | Fee | Deposit/Withdrawal processing time |

|---|---|---|

| Bitcoin | Free | Within 24 hours |

| Ethereum | Free | Within 24 hours |

| Debit/credit cards | It varies depending on the currency. In the case with US dollars, the fee ranges from $0 to $10. | from 2 to 5 days |

| Electronic payment systems | It varies depending on the currency. In the case of the US dollar, the fee ranges from $0 to $10. | from 0 to 5 days |

Kraken Trading Platforms

Kraken’s distinctive feature is its 3 apps for smartphones that make trading much easier. Android and iOS phone owners can install one of the three apps: New Kraken, Kraken Futures, Kraken Pro.

- New Kraken is well suited for beginners and undemanding traders. It has all the basic features and instruments for trading and detailed cryptocurrency statistics. The software has a high score in Google Play – 4.2 out of 5.

- Kraken Futures allows users to trade with leverage up to 1:50. The app provides access to futures exchange CME.

- Kraken Pro is the best option and the happy medium between the two apps mentioned above. It features all the benefits of New Kraken and Kraken Futures.

Comparative table of features

| Web | Mobile | Desktop | |

|---|---|---|---|

| Two-factor authentication | Yes | Yes | Yes |

| Time frame range | From 1 minute to 1 week on the trading platform | From 1 minute to 1 week on the trading platform | From 1 minute to 1 week on the trading platform |

| Order types | Limit orders, market orders, limit stop-loss orders, market stop-loss orders, limit take profit orders, bracket orders. | Limit orders, market orders, limit stop-loss orders, market stop-loss orders, limit take profit orders, bracket orders. | Limit orders, market orders, limit stop-loss orders, market stop-loss orders, limit take profit orders, bracket orders. |

| Quote history | Yes | Yes | Yes |

| Number of indicators | Over 90 | 0 | Over 90 |

| TradingView charts | Yes | Yes | No |

Trading platforms. Comparison with competitors

| Kraken | Binance | HTX (Huobi) | |

|---|---|---|---|

| Web platform | Yes | Yes | Yes |

| Android | Yes | Yes | Yes |

| iOS | Yes | Yes | Yes |

| Desktop | Yes | Yes | Yes |

Trading platform specs

The mobile apps allow users to quickly track changes in quotations and make corresponding decisions. Mobile versions of competitor exchanges can boast only a part of the trading functionality of their web versions.

The web platform is better suited for in-depth market analysis. It is easier to use it to analyze charts and price performance. The app is a good option for quick trading, while the web version is better suited for detailed market research.

Analytics

Analytical reports of Kraken experts are periodically published on thematic websites and channels. The YouTube channel of the exchange features webinars, where invited guests and hosts analyze the present state of the digital industry and its growth potential.

Analytical work also includes thematic podcasts, which discuss issues that are relevant to the cryptocurrency industry. Here, you can get useful insights and learn the opinions of experts. The podcasts are published on:

- iTunes

- Spotify

- Google Podcasts

- Youtube

Education

The exchange regularly publishes educational articles on crypto trading on its website. There is a separate section dedicated to the 5 most popular cryptocurrencies in 2022. There is a short history of cryptocurrency development and a price chart for the last 24 hours.

The Kraken team launched a series of articles Crypto 101 for learning the basics of cryptocurrencies. Here are several topics that they cover:

- Where and how can you get Bitcoin?

- Why is Bitcoin so volatile?

- What is blockchain and how does it work?

For those who prefer watching videos over reading articles, Kraken exchange has a YouTube channel. The channel features all educational materials as videos and their analysis is accompanied by explanations of experts. You can also view Kraken webinars, where the prospects of cryptocurrencies, means of protecting your personal account and other issues are discussed.

Customer support

If you have a problem working with the exchange, you can find an answer independently in the vast support section. Despite the fact that the exchange’s website is translated in 13 languages, the support section with information is available only in the following languages:

- English;

- French;

- Italian;

- Portuguese;

- Spanish;

- Japanese.

If you failed to find an answer to your question, you can contact a support agent. There is also an alternative option – you can communicate with customer support by email.

Communication channels of Kraken

Latest news about Kraken are published on the exchange’s social media:

- Telegram: @kraken_futures

- Facebook: www.facebook.com/KrakenFX

- Twitter: www.twitter.com/krakenfx

- Reddit: www.reddit.com/r/Kraken/

- Instagram: www.instagram.com/krakenfx/

- YouTube: www.youtube.com/channel/

- Linkedin: www.linkedin.com/company/kraken-exchange/

Customer support languages of Kraken

The website of the exchange is translated into 12 languages:

- Chinese

- English (UK)

- English (USA)

- Filipino

- French

- Italian

- Japanese

- Portuguese (Brazil)

- Russian

- Spanish

- Turkish

- Vietnamese

You can use any of these languages to contact customer support.

Kraken Bonuses and Promo

The exchange offers investors beneficial conditions of partnership through an affiliate program. The payout for each attracted user is 20% of the trading fees collected from him. The maximum bonus amount per one referral is $1,000. Features of the affiliate program:

- Trading fee calculations include spot trade fees, margin opening fees and margin rollover fees.

- No deadlines.

- Payouts directly to your bank account instead of an exchange account. Payouts by bank transfer. You will receive the payment in your bank account's default currency.

Summary

Let’s sum up this review and talk about who Kraken is best suitable for.

The following factors need to be taken into account before starting to trade:

- Small number of traded coins can be a turn-off for experienced traders, who are attracted by the variety of assets.

- Kraken allows you to reduce the trading fees to zero subject to specific trading volume. This attracts experienced traders with serious capital to the exchange.

- Through mandatory verification, the exchange enforces KYC, which clearly benefits honest traders who seek transparency.

- Absence of a demo account makes it difficult to learn and develop the skills of working with the exchange’s tools.

So, here’s our conclusion: Kraken is a reliable platform with a long history. It has never been hacked; it is accredited in the developed countries. Reliability and low fees attract players with big capital. All of this allows the cryptocurrency exchange to lead in terms of liquidity ratio (second only to the largest trading platform Binance).