Binance Review 2024

Binance is the largest cryptocurrency exchange by trading volume, technological advancement, and the range of services offered for active trading and investment in cryptocurrencies. It was founded in 2017 in China and has since been continuously growing. For a long time, the founder and main face of Binance remained Changpeng Zhao, who also owns the OKCoin platform.

Binance stands out from its competitors in many respects. The platform regularly demonstrates the highest trading volume, which has now closely approached the $80 billion mark. The number of trading instruments offered is 1,682, with a vast diversity of coins, totaling 395. Additionally, over its existence, Binance has supported a wide range of fiat currencies, totaling 46.

Furthermore, Binance offers a plethora of additional services – an NFT marketplace, a launchpad for crypto startups, P2P exchange, cryptocurrency staking, etc. The exchange offers more favorable trading conditions for clients who hold its native token, BNB, which consistently ranks in the top 5 cryptocurrencies by market capitalization. In recent years, Binance has actively worked with local cryptocurrency exchanges to improve the integration and availability of Binance Coin (BNB) in different regions, especially in Latin America. It has even implemented cross-exchange liquidity agreements to strengthen BNB's position in the global market.

Binance Rating

Binance is rightly considered the leader of the industry, providing a very high level of services and a wide list of opportunities. The table below contains the rating of every aspect of the platform’s operation.

| Total score | 9,4 |

|---|---|

Commissions

Commissions

|

8 |

Security and regulation

Security and regulation

|

9 |

Markets

Markets

|

10 |

Passive income

Passive income

|

10 |

Account opening

Account opening

|

10 |

Deposit and withdrawal

Deposit and withdrawal

|

8 |

Trading platforms

Trading platforms

|

10 |

Analytics

Analytics

|

10 |

Education

Education

|

10 |

Customer support

Customer support

|

9 |

Bonuses

Bonuses

|

9 |

Binance Pros and Cons

Binance is the leader, but not in all aspects. The exchange offers many benefits, but still has some drawbacks, which we will also mention, as this review aims to provide impartial information about the platform and give you the fullest picture.

Basic information

Binance is well-known, in part, due to its powerful advertising campaign, the scale of which significantly surpasses its competitors. As part of its global expansion strategy, Binance has invested in key regional cryptocurrency exchanges and fintech companies. Through the Binance Charity Foundation, the company has supported various humanitarian initiatives, including assistance to Ukraine. Nevertheless, there are still those who have never heard of it. Let's highlight the most important points:

| Name | Binance |

|---|---|

| Website | www.binance.com |

| Exchange type | Centralized |

| Regulation | Binance Holding Limited – offshore (The Cayman Islands), Binance.US – USA, holds licenses of 34 states, there is no definitive information about a license in Europe |

| Taker’s fee | 0.100 – 0.040% |

| Maker’s fee | 0.100 – 0.020% |

| Demo account | Yes |

| Minimum deposit | No |

| BTC withdrawal limits | None for verified accounts, minimum withdrawal is 0.002 |

| USD withdrawal limits | $50,000 per day, up to $2,000,000 per month |

| Withdrawal in Fiat | USD, EUR, GBP, CAD, AUD, CHF, HKD, SGD, ZAR, RUB, TYR, UAH, a total of over 40 currencies |

| Time frame for account opening | From 2 minutes for basic registration to 2 days for full registration |

Binance Commissions and Fees

Binance charges rather flexible fees. Initially their level is average, but as the volume increases they can be considerably reduced. Also, the fees are lower if you use BNB. Let’s review the pros and cons:

Binance trading fees

Binance charges fees both for spot trading and futures trading. The rates cannot be called the best in the industry; they are rather average. Let's consider the fees in the Spot and Margin markets:

| Level | 30-day trading volume (USD*) | and/or | BNB balance | Maker / Taker |

Maker / Taker BNB Discount 25% |

|---|---|---|---|---|---|

| Standard user | < 1 000 000 USD | or | ≥ 0 BNB | 0.1000% / 0.1000% | 0.0750% / 0.0750% |

| VIP 1 | ≥ 1 000 000 USD | and | ≥ 25 BNB | 0.0900% / 0.1000% | 0.0675% / 0.0750% |

| VIP 2 | ≥ 5 000 000 USD | and | ≥ 100 BNB | 0.0800% / 0.1000% | 0.0600% / 0.0750% |

| VIP 3 | ≥ 20 000 000 USD | and | ≥ 250 BNB | 0.0420% / 0.0600% | 0.0315% / 0.0450% |

| VIP 4 | ≥ 100 000 000 USD | and | ≥ 500 BNB | 0.0420% / 0.0540% | 0.0315% / 0.0405% |

| VIP 5 | ≥ 150 000 000 USD | and | ≥ 1 000 BNB | 0.0360% / 0.0420% | 0.0270% / 0.0360% |

| VIP 6 | ≥ 400 000 000 USD | and | ≥ 1 750 BNB | 0.0300% / 0.0480% | 0.0225% / 0.0315% |

| VIP 7 | ≥ 800 000 000 USD | and | ≥ 3 000 BNB | 0.0240% / 0.0360% | 0.0180% / 0.0270% |

| VIP 8 | ≥ 2 000 000 000 USD | and | ≥ 4 500 BNB | 0.0180% / 0.0300% | 0.0135% / 0.0225% |

| VIP 9 | ≥ 4 000 000 000 USD | and | ≥ 5 500 BNB | 0.0120% / 0.0240% | 0.0090% / 0.0180% |

The higher the trading volume, the lower are the fees, which is a great advantage for active traders. However, in order to reduce the fees considerably, you will have to achieve rather high volume indicators.

There is also an option to reduce your fees by 25% when using BNB; it applies to spot and to future trading.

Binance non-trading commissions

There is no fee on deposits in cryptocurrency and the withdrawal rates are determined by the blockchain network only. If your deposit is in fiat money, the fee will be floating, up to 3.3%. Also electronic payment systems are available; for example AdvCash or Payeer can be used for depositing funds with no fee charged.

The exchange does charge a withdrawal fee. For every currency, there is a different fee. For example, if you withdraw to a USD card, the fee is fixed at $15. Withdrawals in cryptocurrencies are also charged with a fee. Here are the most popular ones:

- BTC – 0.0005BTC

- ETH – 0.005ETH

- USDT – 6.55USDT

For the clients with small amounts, a fixed withdrawal fee may turn out to be rather inconvenient, while for large amounts, it will definitely be a big plus.

Average commission compared to competitors

The best way to evaluate the level of the fees is to compare the exchange to its competitors:

| Binance | Kraken | HTX (Huobi) | |

|---|---|---|---|

| Taker | 0.06% | 0.15% | 0.09% |

| Maker | 0.05% | 0.06% | 0.08% |

The rates of Binance commissions and fees can be considered average; they do not match the level of the best offers in the industry, although they are better than those charged by the majority of competitors.

Margin lending

Binance provides clients with an opportunity for margin trading. This means that the traders can use borrowed funds provided by the company. For example, if you have 1 BTC, you can trade 3 BTC with the provided loan. This raises your potential profit, but also the risks.

On the Binance cryptocurrency exchange, different cryptocurrencies are classified into tiers based on their liquidity, and each tier has its own borrowing limits. As the debt amount increases, the maximum available leverage decreases, and the required maintenance margin rate and the minimum initial margin rate increase.

In Cross Margin Pro Margin mode, the margin level is calculated as the ratio of the user's net capital to the total required maintenance margin and is divided into several different levels.

Cross Margin Pro Margin Level = ∑Net Equity / ∑Maintenance Margin,Please refer to FAQ for detailed information.

More detailed information on margin trading, including various levels and limits, can be found in the relevant section on the official Binance

Example:

The user borrowed 13 BTC and 13 ETH. Suppose that BTC price = 30,000 USDT and ETH = 3,000 USDT, then the required Initial Margin and Maintenance Margin are calculated as follows:

- USDT value of BTC Liability = 13 * 30,000 = 390,000, which falls in Tier 3. USDT value of ETH Liability = 13 * 3,000 = 39,000, which falls in Tier 2.

- Required ∑Initial Margin =∑Initial Margin required by BTC liability + ∑Initial Margin required by ETH liability= 50,000*11.12%+(100,000-50,000)*14.29%+(390,000-100,000)*20%+ 30,000*11.12%+(39,000-30,000)*14.29% = 75,327.1 USDT

- Required Maintenance Margin = ∑Maintenance Margin required by BTC liability + ∑Maintenance Margin required by ETH liability = 50,000*5%+(100,000-50,000)*7%+(390,000-100,000)*8%+ 30,000*5%+(39,000-30,000)*7% = 31,330 USDT

- Required Maintenance Margin can also be calculated in a faster way by using the Maintenance Amount. Liability token Maintenance Margin = Token Liability in USDT* Maintenance Margin Rate - Maintenance Amount. So the Required Maintenance Margin = ∑Maintenance Margin required by BTC liability + ∑Maintenance Margin required by ETH liability= (390,000*8% - 2,000) + (39,000*7% - 600) = 31,330 USDT

This example illustrates the importance of understanding the mechanism of margin trading. The initial margin is the collateral that a trader must provide to open a position, and the maintenance margin is the minimum level that must be maintained to avoid the liquidation of the position. Such calculations help manage risks and determine how much funds need to be maintained in the account to support trading positions. It's important to remember that margin trading amplifies both potential profits and potential losses. Therefore, traders should be cautious and always consider their risk level and experience in trading on financial markets.

Binance Reliability and Regulation

Over the years of its existence, Binance cryptocurrency exchange has grown to be an undisputed leader of the industry with its name known to every person, who is interested in cryptocurrency. The exchange has not been involved in any major scandals and the reviews about the platform are mostly positive. There was an incident involving the theft of funds, but the exchange learned from it and improved its security, including by introducing two-factor authentication. Additionally, the exchange holds licenses in 34 US states.

In 2022, the company increased the staff of its security and compliance team by 500%, invested over $500 million to support innovations in the Web3 and blockchain space through Binance Labs. During the so-called "crypto winter," the company established a $1 billion Industry Recovery Fund, promising to increase the contribution to $2 billion if necessary.

At the same time, the holding itself is registered in an offshore jurisdiction; only certain companies of the holding are licensed. The company is officially called Binance Holdings Limited and it is registered at Sertus Chambers, Governors Square, Suite # 5-204, 23 Lime Tree Bay Avenue, P.O. Box 2547, Grand Cayman KY1-1104, Cayman Islands. Prior to that, Binance was registered in Hong Kong and Malta. Such moves happen often and they are mostly due to the changes of the law, as the cryptocurrency industry still does not have the level of regulation that is usually typical for other financial markets. On the one hand, such jurisdiction makes the operation of the company easier and the tax burden lighter, while on the other hand not all clients are prepared to open accounts and put money into an offshore exchange.

The management is aiming to expand the geographical presence of Binance, actively obtaining licenses, where it is required.

In 2023, Binance underwent significant management changes due to the departure of Changpeng Zhao, related to an investigation in the USA. Zhao agreed to pay a bail of $175 million, leaving $15 million in the court's trust and stepped down from any management role in the company while retaining his status as a major shareholder.

Following these events, Binance faced a massive outflow of funds amounting to about $956 million, which caused concern among users and impacted market stability. In response to these challenges, Binance is considering changing its strategies and business models, strengthening anti-money laundering measures, and improving the transparency of its operations.

Throughout 2023, Binance actively expanded in Southeast Asia, including Vietnam, the Philippines, Malaysia, Indonesia, Thailand, and Singapore, forging partnerships with local players and striving to obtain VASP and EMI licenses.

Binance invested in local fintech sectors and the banking industry and also acquired strategic stakes in local cryptocurrency exchanges, such as MX Global in Malaysia and HG Exchange in Singapore. The company continued to support various initiatives, including charity through the Binance Charity Foundation and investments in blockchain technology capabilities.

Binance Markets and Products

Binance offers its clients a very large list of trading instruments. It is not the largest there is, but the platform is not chasing this record. Usually the cryptocurrencies that pass the inspection in terms of their reliability and legality are admitted to the exchange. This allows the platform to prevent ‘image’ losses due to listing dubious projects.

Pros and cons of market diversity on Binance

Let’s review the pros and cons of the list of markets the exchange offers:

For a long time, the Binance exchange offered its users its own stablecoin, BUSD, which is fiat-backed and pegged to the US dollar. However, in 2023, Binance announced the gradual discontinuation of support for BUSD by February 2024. This decision was made after Paxos, the issuer of BUSD, stopped issuing new BUSD tokens. Users are encouraged to convert their BUSD into FDUSD (First Digital USD), another stablecoin supported on the platform. A 1:1 conversion is offered through the Binance Convert feature.

Notably, there are also interesting crosses between altcoins and ETFs.

Binance Markets

Let’s review and compare trading instruments offered by Binance and the competitors of the exchange:

| Binance | Kraken | HTX (Huobi) | |

|---|---|---|---|

| Cryptocurrencies* | 584 | 195 | 584 |

| Trading pairs* | 1594 | 598 | 1135 |

| Bitcoin | Yes | Yes | Yes |

| Ethereum | Yes | Yes | Yes |

| Altcoins | Yes | Yes | Yes |

| Futures and options | Yes | Yes | Yes |

| Cryptocurrency funds (a basket of cryptocurrencies in one lot) | No | No | No |

| NFT | Yes | No | Yes |

Binance is one of the best platforms in terms of the offered trading instruments, which includes the number of the coins and the pairs, including exotic ones. Binance does not hold the record in terms of this and there are exchanges even with a larger choice of instruments, but what Binance offers is more than enough. Not every trader will be able to view this number of charts, but it is definitely an advantage for professional traders.

Binance also has a developed NFT marketplace. This is a new, but already popular area of trading, where you can buy ownership rights to a cryptographic artifact. In other words, you can buy a tune or an image in the form of a token, which is non-fungible.

Cryptocurrencies - Spot

A large number of the coins available on Binance allows the platform to create many cryptocurrency pairs, the spot market is represented by 1,561 trading pairs. The competitors do not have such a number of pairs and only 2 platforms offer a bigger selection. However, Binance management does not add just any coin; it is rather an advantage, since it takes some time to understand the prospects of a new coin. Binance offers a separate section with cryptocurrencies that were recently added to the listing. If you want, you can start trading them.

Cryptocurrencies - Futures

Binance provides access to trading cryptocurrency futures. It is a convenient and simple instrument that allows you to reduce your commission expenses, as they are much lower than in the spot market.

There are futures of two types:

- Quarterly.

- Perpetual.

This type of trading attracts speculators with a large number of trades the most. They don’t hold positions for long and some can open several dozen positions within a trading day. In these conditions, the expenses become an important factor and they are the lowest for futures.

Passive income on Binance

Binance provides great opportunities for earning passive income. It will require either capital or equipment. Let’s take a look at the offers:

Binance Launchpad

What it is: Binance Launchpad acts as a platform for Initial Coin Offerings (ICOs) and token launches. It aids crypto project developers in launching new tokens and raising funds by providing access to Binance's large user base.

Functions: Launchpad conducts thorough selection and vetting of projects, offering investors quality and reliable options for investing in new cryptocurrencies.

Advantages: Users are given the opportunity to participate in the early stages of projects, which can lead to high returns if these projects are successful.

Binance Launchpool

What it is: Binance Launchpool is a platform that allows users to earn new tokens by staking their cryptocurrency assets.

Functions: Users can stake their funds in special pools on Binance and receive new tokens in return. This is a way to earn from staking, where users can simultaneously support new projects.

Advantages: Launchpool provides a simple and less risky way of obtaining new tokens, as well as helps in distributing these tokens among Binance's wide audience.

Both platforms strengthen the Binance ecosystem by offering new opportunities for investment and earning to users, and effective tools for raising capital and community engagement to crypto project developers.

It's noteworthy that at the beginning of 2024, there were more than 80 launched projects available for participation on the platform.

The Binance exchange has also created the Binance Pool mining platform. It provides users with opportunities for mining various cryptocurrencies, including Bitcoin (BTC) and other popular coins. Binance Pool is closely integrated with other Binance services, including spot and futures trading, as well as staking products.

Key advantages of Binance Pool:

Low Fees: Binance Pool offers some of the lowest fees in the market, making it an attractive choice for miners.

Support for Various Algorithms: The platform supports multiple mining algorithms, giving miners flexibility in choosing the most profitable option.

Community and Support: Miners in the Binance Pool can take advantage of the resources and support of the Binance community, as well as access to educational materials.

Binance Referral Program

Binance cryptocurrency exchange offers a very simple and convenient system of referral bonuses that allows you to make passive income by referring new clients. You only need to generate a referral link in your personal account and send it to the future client of the exchange and that person needs to use it during registration. After that, the commission will be calculated in real time mode and will be credited once an hour. You can also specify some settings:

-

The referral rate

It is set depending on the daily volume. If it is less than 500 BNB the referral rate is 20. If it is higher than that, the referral rate can be up to 40%. -

You can also share the commission with the invited friend.

You can also set it up on your own.

Notably, there are different links for spot and futures markets. They can also be generated as a QR code, as this technology is becoming increasingly popular.

Account opening on Binance

Opening an account on Binance literally takes a couple of minutes. First, basic features will be available and you will need to verify your account in order to have access to wider features. Verification of documents may take up to 2 days. Once it is complete, you will be able to use the full range of the services offered by the exchange and with rather extended limits.

Residents of which countries can trade at Binance

The situation with client service and account registration changes constantly due to the pressure of the authorities. Nonetheless, Binance cryptocurrency exchange manages to get some limitations lifted. At the moment, registration is prohibited for the residents of Belarus, Iran, and North Korea. This, however, is a standard list for many platforms and not only cryptocurrency exchanges.

A separate company was established for the US residents, which obtained licenses for each state and this process continues. Despite the statements about stopping the services for the clients from Europe, registration for EU residents is currently available.

How to open an account on Binance:

a step-by-step guide

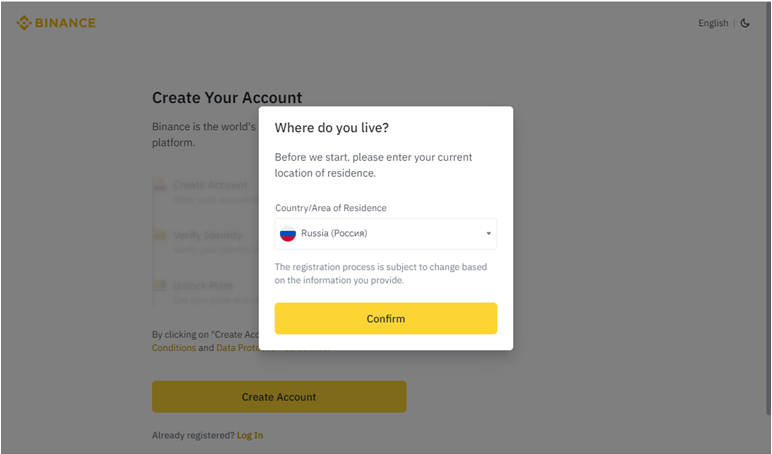

In order to become a client of the exchange, you need to access binance.com and take several simple steps:

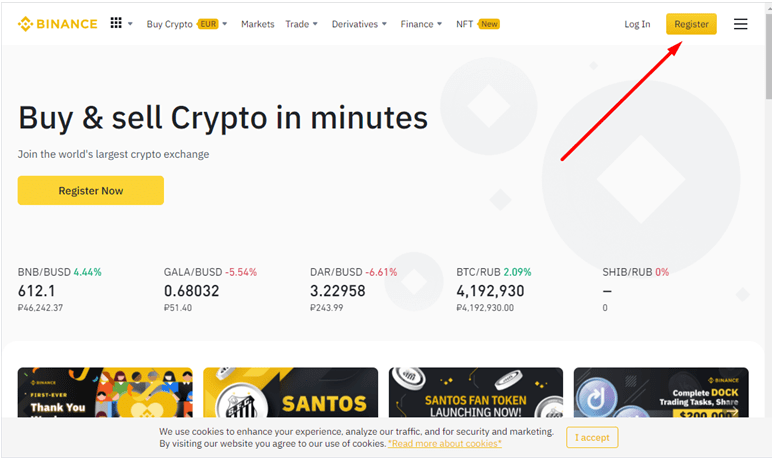

Click Register www.binance.com

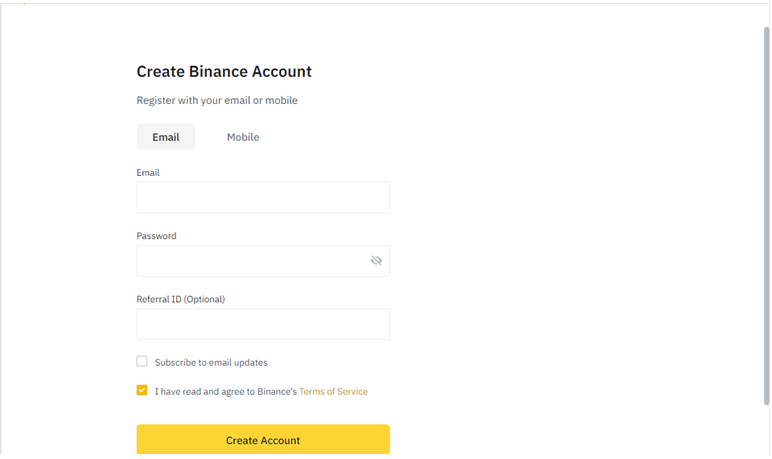

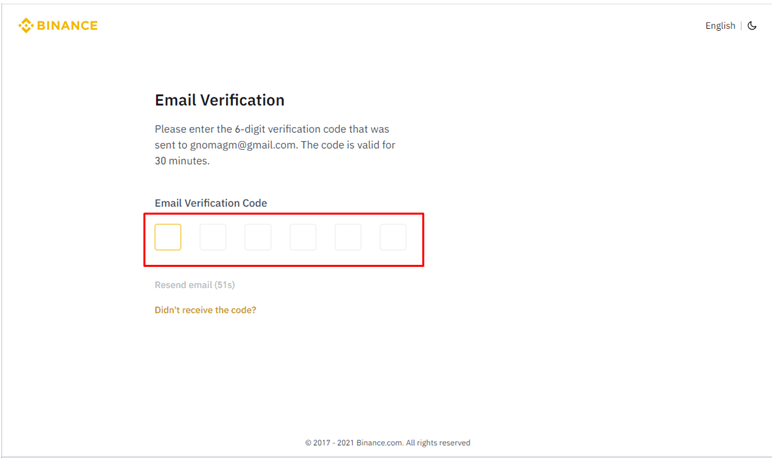

Provide your email and come up with a password. Pass security verification (anti-spam).

The account has been created. Now you need to verify your ID. Select Individual.

Provide your name, country/area of residence. Next, enter your mobile phone number, where the text message with a code will be sent. Also provide your date of birth.

After you’ve entered the code, you will be assigned Level 1. This means that you can trade and withdraw cryptocurrency with a daily limit of $2,000.

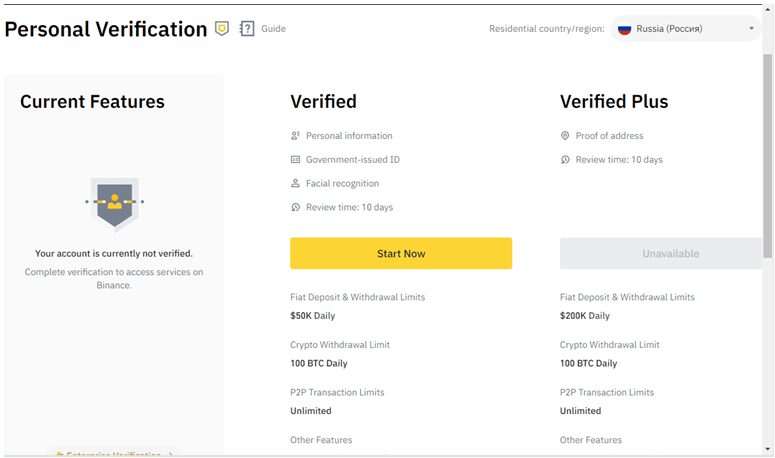

Next, you need to pass personal verification.

Upload the documents and wait for the verification to be completed.

As you can see, everything is simple and clear. You shouldn’t experience any difficulties. In order to have all trading features and expanded limits, upload documents for verification. Usually, it does not take longer than 2 days for Binance specialists to verify your documents and upgrade your status.

Minimum deposit on Binance

You can trade any amounts on Binance; the limitations apply only to the transfers. If the exchange accepts 0.01 of any cryptocurrencies, then that is the minimum deposit. As for fiat money, deposits through providers usually have a minimum amount of $10. Accordingly, those amounts should be viewed as minimum deposits.

Binance Account types

Trading possibilities of Binance clients depend on the volume of information they provided about themselves. There are three verification levels:

| Level | Withdrawal limit | Specifics |

|---|---|---|

| Verified | Up to 50K USD per day | Scanned copy of the passport with a photo and address, photo holding the passport |

| Verified Plus | Up to 2M USD per day | Verified + as well as address verification. |

| Verified Plus (Extended) | Unlimited fiat transactions | Comprehensive Enhanced Verification |

Deposit and withdrawal on Binance

Binance cryptocurrency exchange boasts one of the longest lists of supported fiat, which includes 46 currencies. Here are the most popular ones:

- USD – US dollar.

- EUR – Euro.

- GBP – British pound.

- CAD – Canadian dollar.

- CHF – Swiss franc.

- AUD – Australian dollar.

- MXN – Mexican peso.

- UAH – Ukrainian hryvnia.

There is also a long list of cryptocurrencies. It is important to see which blockchain network you choose when making a deposit. The most popular coins are:

- BTC

- ETH

- EOS

- BNB

- USDT

The best way to deposit funds to your account on Binance is with cryptocurrency as no fees are charged on those deposits. On the Binance cryptocurrency exchange, one of the features is the ability to trade peer-to-peer (P2P) without charging any fees. This means that users can directly exchange cryptocurrencies without incurring additional transaction costs.

The advantages of this approach are numerous. Firstly, the absence of fees makes the exchange process more favorable for both parties involved. It also contributes to increased liquidity on the platform because market participants can conduct transactions more freely and frequently. Secondly, P2P trading on Binance gives users more control over exchange rates as they can directly negotiate prices with other market participants.

This is why many users use P2P trading on Binance as a convenient way to deposit or withdraw funds. With a wide selection of payment methods and currencies, users can effectively manage their funds, conducting exchanges at their convenience and with minimal expenses. This makes P2P trading on Binance a popular choice among traders seeking maximum efficiency and flexibility in managing their cryptocurrency assets.

Deposit and withdrawal options and processing time

Let’s review the information about fees in the table below:

| Method | Deposit/Withdrawal processing time | Fee |

|---|---|---|

| Cryptocurrencies | Determined by the regulation for transaction confirmation. Usually up to 1 hour | Specific for each cryptocurrency |

| Wire transfers | 1-3 working days, depends on the bank and whether there are intermediaries for the transfer | Up to 3.3% depending on the bank and 0% for electronic payment systems |

Binance Trading Platforms

Binance stands out among other cryptocurrency exchanges by having its own desktop application. Not everybody finds it convenient to trade in the browser, particularly professional traders. Taking into account the large number of clients and different demands, the company decided to provide a trading platform for PCs featuring increased performance and advanced functionality.

Comparative table of features

If you look at the trading platforms offered by the exchanges, you will see that all of them have more or less the same features. Binance stands out with its PC version, which can also be installed on a Linux OS, which many people consider an advantage.

| Web | Desktop | Mobile | |

|---|---|---|---|

| Two-factor authentication | Yes | Yes | Yes |

| Time frame range | From one minute to one month | From one minute to one month | From one minute to one month |

| Order types | Stop, Limit, Trailing Stop, Stop Market, Post Only | Full set – Limit, Market, Stop Limit, Stop Market, Trailing Stop, Post Only, Limit TP and SL | Basic set with Stop and Limit orders |

| Quote history | Yes | Yes | Yes |

| Number of indicators | Over 100 | Over 100 | Over 30 |

| TradingView charts | Yes | Yes | No |

The desktop version is characterized by the widest functionality, which fully duplicates the web platform and has a number of additional features, for example, a larger list of order types. Notably, it is particularly popular among miners, including on Binance pool, as it is easy to manage farms on Linux OS – a special version was created on the basis of this operating system.

Trading platforms. Comparison with competitors

Let’s look at the list of Binance platform as compared to the competitors:

| Binance | Kraken | HTX (Huobi) | |

|---|---|---|---|

| Web | Yes | Yes | Yes |

| Android | Yes | Yes | Yes |

| iOS | Yes | Yes | Yes |

| Desktop | Yes | Yes | Yes |

Cryptocurrency exchanges are similar in terms of the software they offer, although the largest platforms try to offer the widest list of options and also offer desktop apps. In terms of this, Binance is definitely the leader, offering not only Windows, but also Linux.

Binance trading platform specs

Despite the generally similar features, the platforms do have some distinctions. First, let’s list the common features:

- Two-factor authentication.

- Access to a full range of trading instruments and to charts and analysis tools.

- Traders have access to all possible methods of showing price movements – lines, Japanese candlesticks, bars.

- Availability of built-in analysis algorithms in the form of indicators. All classic indicators (MA, Stochastic, RSI, etc.) are available.

- A possibility to conduct chart analysis – building trend lines, channels.

The web app also offers:

- A bigger list of available order types.

- A possibility to use TradingView charts.

Desktop version has the most features, including original indicators, which are not available in the standard list.

Analytics on Binance

Binance has launched a separate YouTube channel that has been rapidly filling with content for several years. The content primarily focuses on events related to the exchange itself, and here are the main directions:

Exchange News: The channel covers news and updates related to the exchange, providing users with the latest information about Binance's activities and developments.

Educational Materials: The channel offers materials that explain various mechanics of how the exchange works and how users can interact with the exchange and other trading participants. This educational content helps users better understand the cryptocurrency market and trading strategies.

Trading Principles and Strategies: It also provides insights into trading principles and some trading techniques. These videos can be valuable for both novice and experienced traders looking to improve their trading skills and strategies.

This YouTube channel serves as an informative resource for Binance users and the broader cryptocurrency community, offering a platform for learning, staying updated, and enhancing trading knowledge and skills.

Overall, analytics on Binance corresponds to the level of the industry leader. The exchange’s website features a large number of articles and materials dedicated to new projects, analysis of the existing ones and general research on the digital assets. Let’s look at the pros and cons:

Education on Binance

There is a section on the website titled Binance Academy, where you can find useful articles with information about cryptocurrencies – from what a blockchain is to technical analysis. In addition, the exchange holds webinars on its YouTube channel.

Information for beginners is divided into categories, which allows one to learn about cryptocurrencies and how they work step by step. This also provides an opportunity to quickly learn basic information. After you’ve done that, you can move on to more complex materials, for example, detailed descriptions of specific projects, their pros and cons. Binance educational program is one of the most extensive ones online and it is well structured.

It's important to note the inclusion of current topics such as DeFi, NFTs, Bitcoin ordinals, and inscriptions, ensuring users receive the most up-to-date and relevant information. The enhancement of interactive elements and self-learning tools, including videos, articles, and quizzes, is also noteworthy.

Binance regularly conducts webinars on various topics, ranging from cryptocurrency basics to advanced trading strategies and market analysis. The platform collaborates with renowned experts and influential figures in the crypto community to conduct these webinars.

In 2024, it's notable that the expansion of course offerings includes interactive modules and tests, aiding users in better assimilating the information.

Binance has stepped up collaborations with leading universities worldwide to integrate cryptocurrency and blockchain courses into educational curricula. The provision of internships and participation in research projects cannot be overlooked, as it allows students to gain practical experience in the cryptocurrency field. The implementation of grant and scholarship programs to support education and research in cryptocurrency and blockchain technology is also significant.

Customer support on Binance

The exchange offers an extensive FAQ section with the answers to the most popular questions. If you still haven’t found the answer, you can contact customer support via a live chat. First, a bot will respond and try to help you and then, if that does not help, an operator will respond within a minute and help you resolve your issue. There is also a feedback form; in this case the response is sent to your email within 24 hours. Let’s review the pros and cons of Binance customer support:

Communication channels

The exchange has accounts on social media, where you can ask questions and learn useful information:

- Telegram: @binanceexchange

- Instagram: @Binance

- Youtube: Binance

- Reddit: Binance

- Vkontakte: Binance

- Website: Support Binance

Customer support languages

Due to the fact that Binance is available in many countries, customer support of the exchange is available in several languages:

- English.

- Chinese.

- Russian.

- Turkish.

- Spanish.

- Portuguese.

- Vietnamese.

- Korean.

Binance Bonuses and Promo

Binance often conducts a variety of contests and promotions, the terms of which can significantly differ for users from different regions.

Referral Program: Users can earn bonuses for attracting new clients. For example, if someone uses a user's referral link to register and conducts transactions for a certain amount, both receive a bonus.

Limited-time Promotions: Binance frequently runs temporary promotions, offering increased interest rates for staking or bonuses for participating in specific trading activities.

Special Offers for Certain Cryptocurrencies: At times, Binance provides bonuses for buying or trading specific cryptocurrencies.

Contests and Competitions: Various contests are held where users can win prizes for activity on the platform or achieving certain goals in trading.

It's important to note that the conditions and details of these promotions are constantly updated, and they are available at different times throughout the year. Moreover, some promotions are only available in certain regions or for specific users. Therefore, we recommend registering now and checking the current information directly for your account on the Binance website or in the company's official announcements.

Summary

Summing up, you can definitely agree that Binance is the true leader of the industry. While you can find better offers in certain aspects, in terms of their totality the exchange does not have many competitors. Binance will be an ideal choice for:

- Active traders and speculators. Quick increase of trading volume will help you substantially reduce commissions and fees and a wide selection of instruments helps you receive a large number of trading signals.

- Supporters of reliable and reputable projects. Binance thoroughly selects coins for listing. This leads to a significant increase in cost as compared to the initial price, but reliability takes priority.

- Miners. Availability of own pool makes the work with mined cryptocurrency much easier.

- Stakers. Developed staking system offers new options and the annual interest is enticing.

Traders with small capital are the only category of crypto traders, for whom Binance may not be as interesting. Commissions are not favorable for trading with a small deposit. In order to reduce them, you need to either have BNB or high turnover. It is possible to trade exclusively futures, as the commissions are lower there, although there are exchanges that don’t charge fees on futures.

BEST EXCHANGE FOR BEGINNERS

BEST EXCHANGE FOR BEGINNERS