OKX Review 2024

OKX is one of the top cryptocurrency exchanges that enjoys high popularity among traders. The platform offers a number of benefits, which include low commissions and fees, a huge choice of assets in different categories (spot, futures, options, etc.), support of fiat money.

Today, OKX is the largest Hong Kong exchange with a daily turnover at more than 20,000 BTC, servicing millions of clients.

The exchange is quite popular in many countries across the world, offering loyal and rather good conditions for trading digital assets.

OKX crypto exchange ranking

| Total score | 8 |

|---|---|

Commissions

Commissions

|

9 |

Security and regulation

Security and regulation

|

6 |

Markets

Markets

|

10 |

Passive income

Passive income

|

9 |

Account opening

Account opening

|

9 |

Deposit and withdrawal

Deposit and withdrawal

|

8 |

Trading platforms

Trading platforms

|

7 |

Analytics

Analytics

|

5 |

Education

Education

|

8 |

Customer support

Customer support

|

5 |

Bonuses

Bonuses

|

8 |

OKX Pros and Cons

Basic information

| Name | OKX |

|---|---|

| Website | www.okx.com |

| Exchange type | Centralized |

| Regulation | No |

| Taker’s fee | Spot – 0.1% Futures – 0.05% |

| Maker’s fee | Spot – 0.08% Futures – 0.02% |

| Demo account | Yes |

| Minimum deposit | No, but there are deposit minimums in each currency |

| BTC withdrawal limits | 500 per day |

| USD withdrawal limits | 500,000 (in USDT token) |

| Withdrawal in Fiat | No |

| Time frame for account opening | Up to 36 hours with 1 Level verification |

| Leverage | Up to 125x |

| Markets | 691 |

| Passive income options | Staking, margin lending |

| Customer support languages | English |

| Withdrawal fee | Calculated individually for each asset + blockchain fee |

| Deposit options | Cryptocurrencies, bank account, debit card |

| Withdrawal options | Cryptocurrencies, bank account, debit card |

| Account currencies | BTC, ETH, USDT |

| Promo | Referral program, bonuses within 30 days after registration |

OKX Commissions and Fees

The analysis of the operation of OKX cryptocurrency exchange revealed that the platform offers a simple and clear system of calculation of commissions and fees separately for each category of assets. You can find detailed information about the fees in the corresponding section on the website.

Trading fees

The exchange currently charges fees depending on the trading level on a specific account. There is also additional differentiation by regular fees (5 tiers) and fees for VIP users (8 tiers).

Regular users are assigned a specific tier based on the amount of OKB (the currency of the exchange) they have on their account and the VIP tiers are assigned based on the trading volume.

Notably, a tier is assigned to the user based on the highest trading volume on any market: spot, futures, options. For example, if your 30-day spot trading volume for the past month amounted to USD 20,000,000 (VIP 2), futures trading volume was USD 200,000,000 (VIP 3), and options – USD 5,000,000 (VIP 1), the fee will be calculated in this case based on the VIP 3 tier and the discount will be available across all markets, including spot, futures, swaps and options.

The fees also differ depending on the class of the asset. There are three classes of assets on the platform:

- A – top cryptocurrencies (BTC, ETH, LTC, OKB, OKT, BCH, BSV, ETC, EOS, TRX, XRP);

- B – second-level tokens;

- C – assets created in the Ethereum blockchain or other large blockchains.

Notably, the fees are the same for classes A and C, but totally different for B.

Let’s take a closer look at the fees for ordinary users.

| Market | Total OKB holding | Maker | Taker |

|---|---|---|---|

| Spot (classes A and C) |

<500 | 0,08% | 0,1% |

| ≥ 500 | 0,075% | 0,095% | |

| ≥ 1000 | 0,07% | 0,09% | |

| ≥ 1500 | 0,065% | 0,085% | |

| ≥ 2000 | 0,06% | 0,08% | |

| Spot (class B) | <500 | 0,06% | 0,06% |

| ≥ 500 | 0,055% | 0,06% | |

| ≥ 1000 | 0,05% | 0,06% | |

| ≥ 1500 | 0,045% | 0,06% | |

| ≥ 2000 | 0,04% | 0,06% | |

| Futures (classes A and C) | <500 | 0,020% | 0,050% |

| ≥ 500 | 0,018% | 0,045% | |

| ≥ 1000 | 0,017% | 0,040% | |

| ≥ 1500 | 0,016% | 0,035% | |

| ≥2000 | 0,015% | 0,030% | |

| Futures (class B) | <500 | 0,015% | 0,03% |

| ≥ 500 | 0,013% | 0,03% | |

| ≥ 1000 | 0,012% | 0,03% | |

| ≥ 1500 | 0,011% | 0,03% | |

| ≥ 2000 | 0,010% | 0,03% |

The fees for the traders start at 0.06% (maker) and 0.08% (taker). However, as the trading volume increases, the fees can be reduced up to negative for the maker. Notably, negative fee is a rather popular practice at different exchanges aimed at the economic growth of the platform.

The fees system is the same for trading futures, perpetual swaps and options:

- 0,02%-0,015% – maker;

- 0,05%-0,03% – taker;

- 0,01% – maker (VIP user);

- 0,03% – taker (VIP user).

You can learn more about the fees and trading volume requirements in the Fees section by choosing the corresponding category of tokens and class.

Notably, together with the fees, also the daily withdrawal limits differ based on the levels. If necessary, however, you can contact customer support to increase your limit.

Basic maker’s fees of the exchange are much lower than those charged by the competitors. The taker’s fees are at the same level with other exchanges. However, with active trading and the use of OKB tokens, users can reduce their fees up to their negative value. This is a definite advantage of the OKX exchange.

Average commission compared to competitors

| OKX | Binance | HTX (Huobi) | |

|---|---|---|---|

| Taker | 0.08% | 0.06% | 0.09% |

| Maker | 0.06% | 0.05% | 0.08% |

Non-trading fees

The exchange does not charge a deposit fee regardless of whether the deposit is made in cryptocurrency or fiat. However, your bank may charge a transaction fee. There is also no fixed withdrawal fee, however, the user will have to pay the blockchain fee, which is calculated depending on the transaction amount and the current workload of the blockchain.

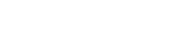

Margin lending

The exchange offers leveraged trading. It is an excellent opportunity to increase your working capital. Similarly to trading using your own funds, there is a multi-tier system of rates here depending on the chosen asset and trading volume. The information about interest rates and daily limits is available in a separate page.

You no longer need to worry about levels, changes and other unforeseen circumstances, as all the required information is available in one place and is regularly updated.

As for the conditions of leveraged trading, they are more than favorable.

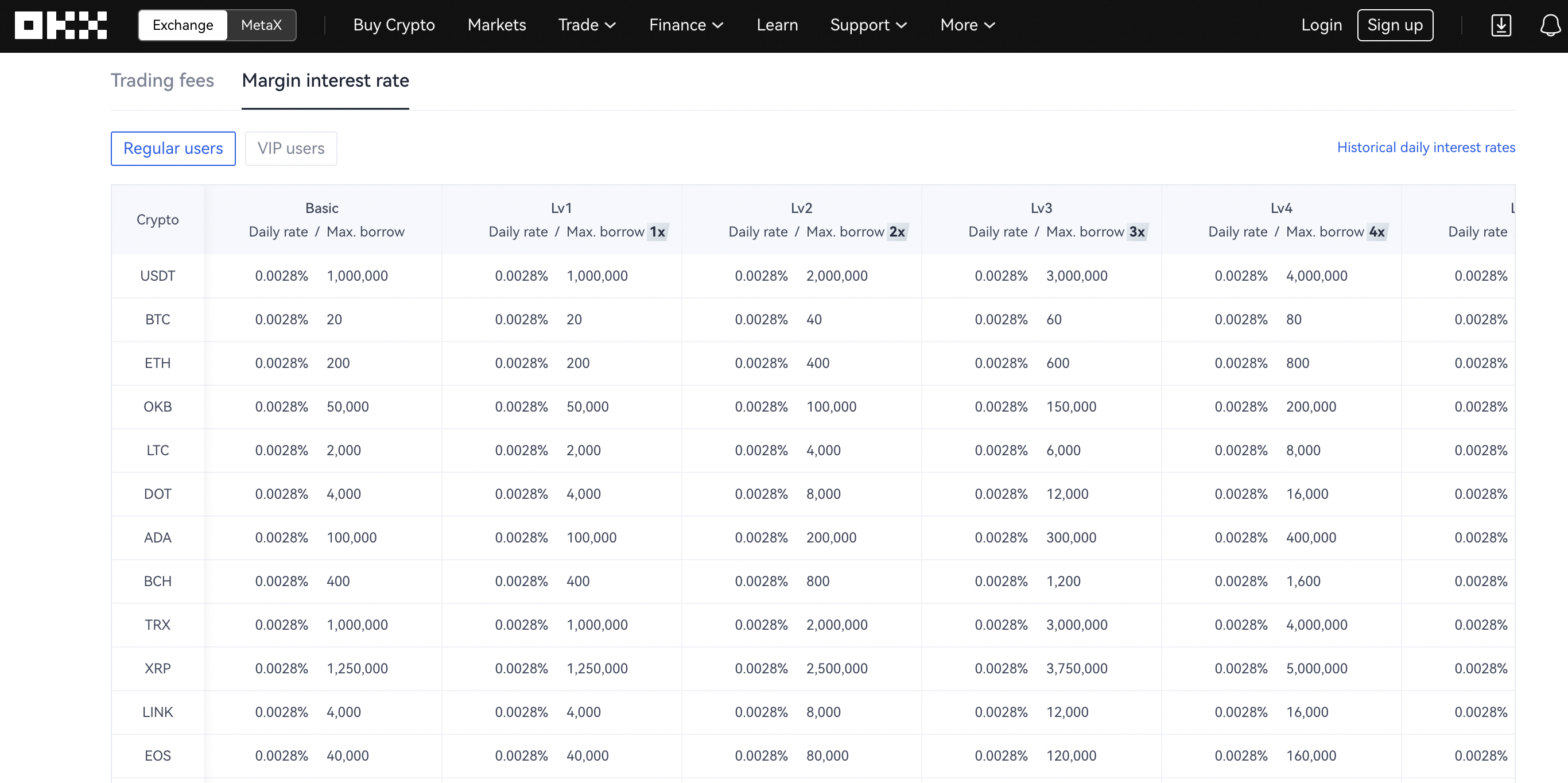

There is a separate panel with a set of tools for working with borrowed assets.

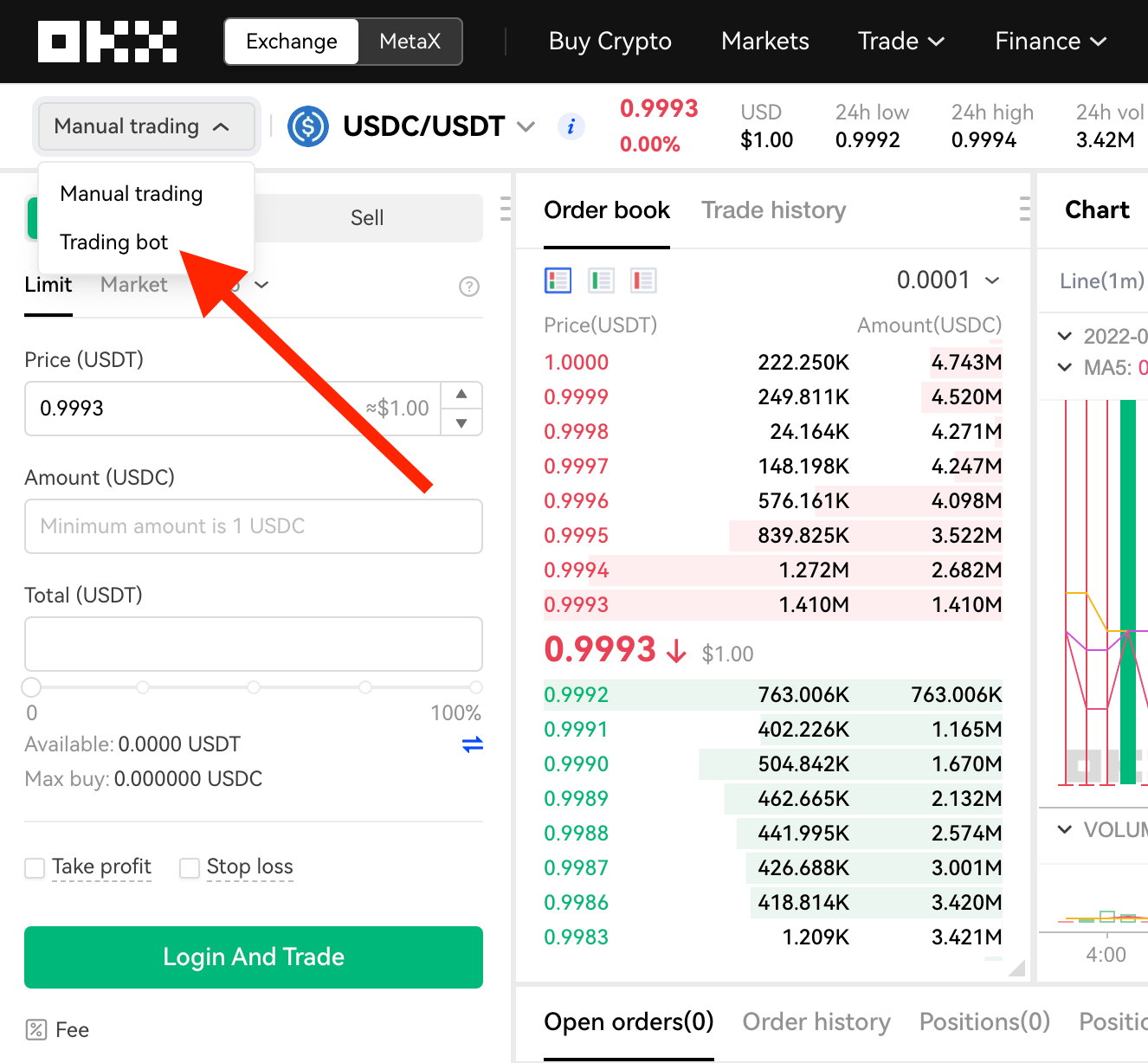

The panel for margin trading is practically identical to the one used for spot trading, with the key difference being the ability to set the leverage.

You can also choose the type of margin calculation:

- Isolated. Profit and margin are calculated separately. At that, the top value of position liquidation loss cannot be higher than the margin of the specified position.

- Cross. In this case, the price of the traded token is the limit. This means that the top value of the position liquidation loss cannot be higher than the cryptocurrency balance.

In order to trade with leverage, you need to decide on the type of margin calculation, cost of asset (the BBO feature allows you to trade at the best prices in the market), and number of assets you intend to buy. If necessary, you can add Take Profit and Stop Loss. Also, if you are just starting to trade with leverage or do not wish to continuously control the process of position closing, you can use a trading bot.

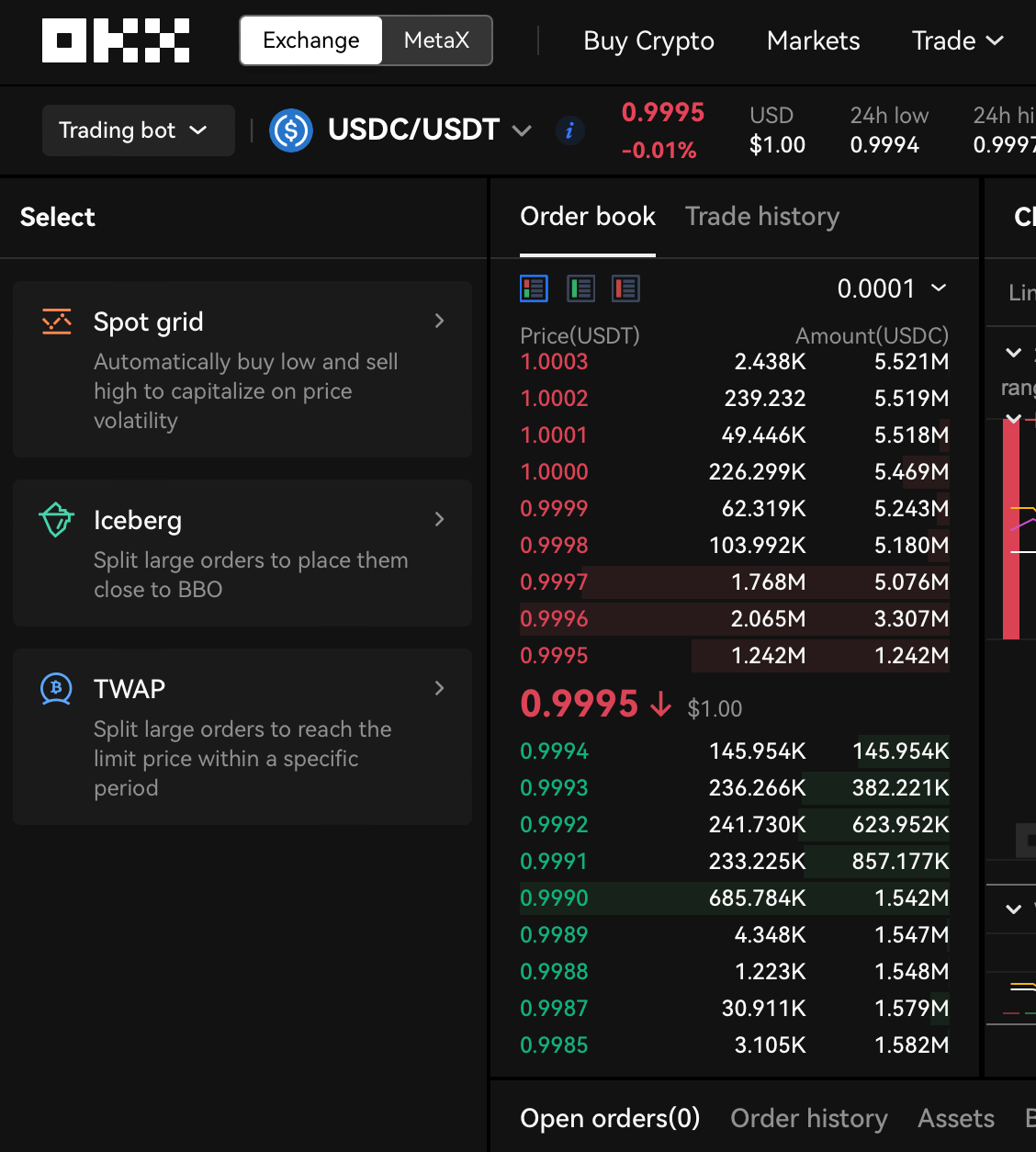

In this case, the trading will be carried out based on the developed algorithms. There are a total of three algorithms: by spot grid, iceberg and time average price. Opening the bot, you can set up the criteria and then wait for the automatic closure of your positions.

Note! In order to trade borrowed funds, the user needs to make a deposit, which will be held in the margin account. After that the system will calculate the base interest rate (taking into account supply and demand for the current loans).

Reliability and regulation

OKX cryptocurrency exchange was initially registered as OKX Technology

Limited in Hong Kong.

OKCoin, which is registered in California, is the “older” sister company

of OKX. The founder of the platform Star Xu launched the first project,

i.e. cryptocurrency and futures trading service OKCoin, at a time, when a

prohibition on development of blockchain project was being actively

lobbied in the U.S. Therefore, he chose a better spot for building his new

empire and founded OKX in Hong Kong.

In 2018, following Binance, OKX moved to Malta, as the company’s

management believed in advanced thinking of the Maltese government

regarding compliance with the KYC principles and algorithms.

The company currently operates under the laws of the country of its

regulator. However, there is no information about the international

license of the company. Therefore, on the one hand, the traders are

offered the best conditions for trading and a wide range of assets, but on

the other hand, the company has no license for this kind of activity.

Notably, the management of the exchange takes care of the safety of the

funds of its clients, employing the latest technologies, such as server

cluster distribution, GSLB, etc.

In order to improve account security, the traders are recommended to:

- Come up with a complex administrator password (during registration) and set up a reliable financial code (required for withdrawals);

- Activate SMS alerts with a code to confirm transactions;

- Use Google Authenticator to change security settings;

- Set up two-factor authentication.

The password and linking your account to your email are very important. Additionally, there are also the following options:

- a complex Fund password to be used for trading and withdrawals;

- an anti-phishing code, where every letter from the platform contains a special authentication code.

Therefore, if you follow all recommendations and employ all the security measures you can, your data will be safe.

Be that as it may, the exchange did suffer from a hacker attack in January 2020, which resulted in withdrawal, aka theft, of $140 million in Bitcoin. And when the users started to suspect a hack, the administration announced that the major withdrawal of coins was due to the planned maintenance at the exchange. Afterwards, the platform reinforced its security standards. Now, all the funds are safe.

OKX Markets and Products

The exchange offers a wide range of various assets, which are conveniently structured by categories: spot, futures, perpetual swap, options and De-Fi tokens. There are also several passive income options, including lending, staking and referral programs.

OKX markets

| OKX | Binance | HTX (Huobi) | |

|---|---|---|---|

| Cryptocurrencies* | 362 | 395 | 584 |

| Trading pairs* | 798 | 1682 | 1135 |

| Bitcoin | Yes | Yes | Yes |

| Etherium | Yes | Yes | Yes |

| Altcoins | Yes | Yes | Yes |

|

Futures and options |

Yes | Yes | Yes |

| Cryptocurrency funds (a basket of cryptocurrencies in one lot) | No | Yes | Yes |

| NFT | Yes | Yes | Yes |

Cryptocurrencies (spot)

The cryptocurrency market at the exchange is represented by 315 positions. There is a division by popular assets (Class A), second-level tokens (Class B) and coins created on the basis of Ethereum or other blockchain (Class C). Additionally, the cryptocurrencies can be classified by their specification: GameFi, Meme, Layer 2, DeFi, Polkadot, NFT.

The overall conclusion is that the selection of assets is quite diverse.

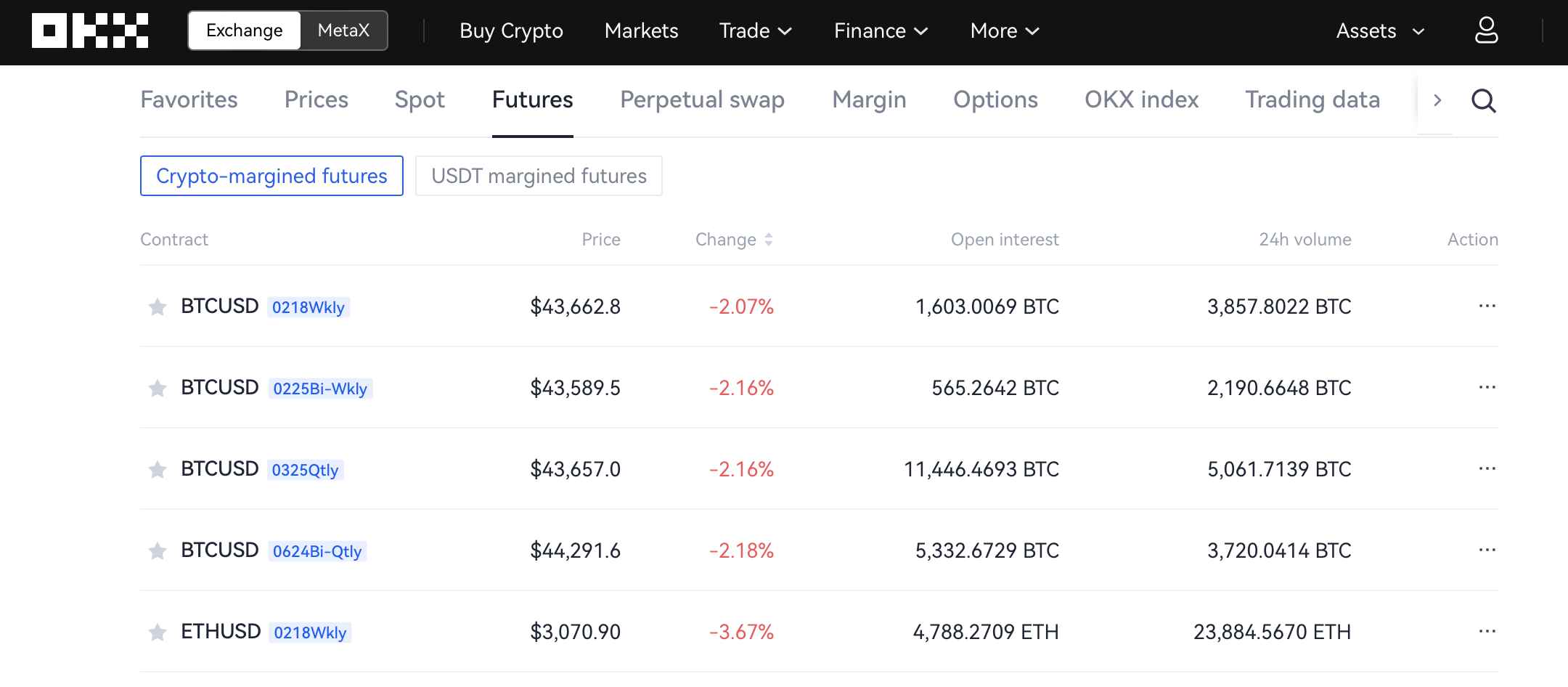

Cryptocurrencies (futures)

All futures contracts at OKX are classified by:

- the underlying asset into cryptocurrency BTC and USDT;

- the term into weekly, two-weekly, quarterly, two-quarterly.

There are a total of 26 contracts in this category at the exchange.

Before starting to trade futures, every trader must pass the test for capital management skills and level of knowledge in this area. After that, you can open the trading page and start trading.

Every contract has its validity period, which is specified in its name.

The principle of working with these assets is rather simple – to buy for less and sell for more. However, unlike spot trading, this is a contract, where the exchange and the traders are the parties.

In order to register the trade, users need to specified basic conditions:

- type of currency;

- number of coins;

- asset price;

- expiry date.

All obligations are binding and predetermined. In order for the contract to have some guarantees, it provides for a deposit margin, which will be returned to the user if all obligations are fulfilled.

The service also offers a calculator, where you can compute the deal in advance: profit, loss, fees and deposit deductions on the margin.

Perpetual swaps

Swaps are another version of contracts available at the exchange. They are similar to futures, but are not as high valued. Essentially, swap is only an opportunity of managing the cost of the underlying asset (cryptocurrency or USDT depending on the chosen position).

The specifics include:

- a possibility of using leverage;

- there is no need to own the underlying asset in order to open a position;

- no expiry date (the period of open position is determined by the availability of uncommitted funds on the user’s account).

Commissions paid to the exchange is an important feature in this case. The calculation is performed twice a day; you can find more details on the rates on the corresponding tab in the Commissions section.

Swaps are mainly used by traders for forming trading strategies for futures.

Option trading on OKX

Option trading at OKX is currently available only for two pairs: BTC/USD and ETH/USD. However, they can differ by:

- type;

- expiry date.

Depending on the type, a contract can be:

- Put – purchased with the expectation of the quote growth.

- Call – purchased with the expectation of the quote decline.

In terms of expiry date, the exchange offers the following options:

- On the next and following trading days;

- On Fridays of the next three weeks, including the current weeks;

- On the last Fridays of the next two months, including the current month.

There is also the expiry date of the last Friday of the month, that happens after six months.

OKB – the token of OKX exchange

The platform has its own token OKB. The coin of the exchange can be used to activate discounts during token sales, and also to pay the fees. As for investing in the token, its profitability is currently very low, which makes it not a very good investment, although it is possible that it will become an excellent investment instrument in the future.

Notably, OKB is currently freely traded. Its emission stands at 1 billion coins, although, according to analysts, only 20% are currently in free access. The coin is developing actively; it is available for purchase at other exchanges and its transition to its own blockchain is possible in the near future.

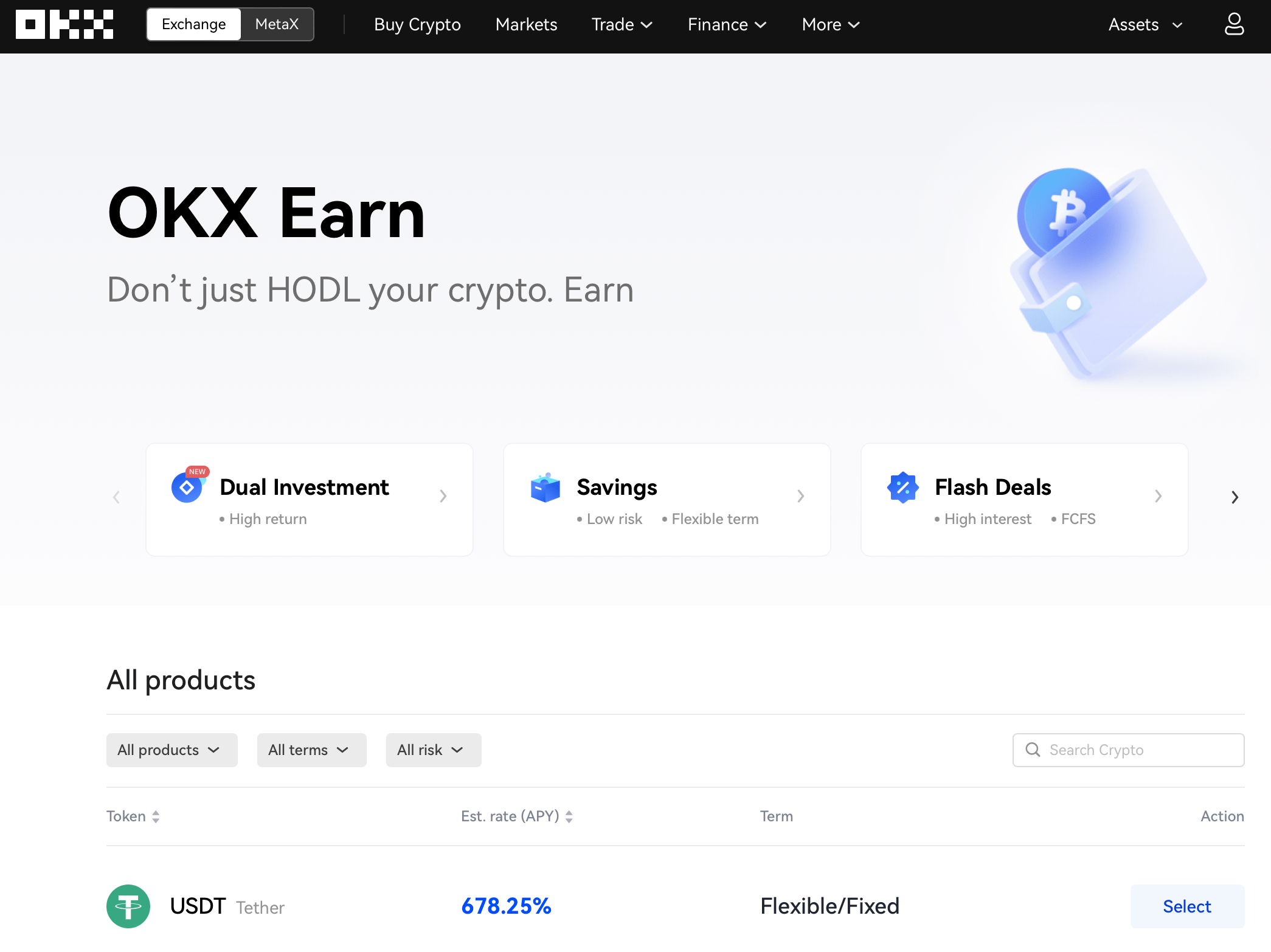

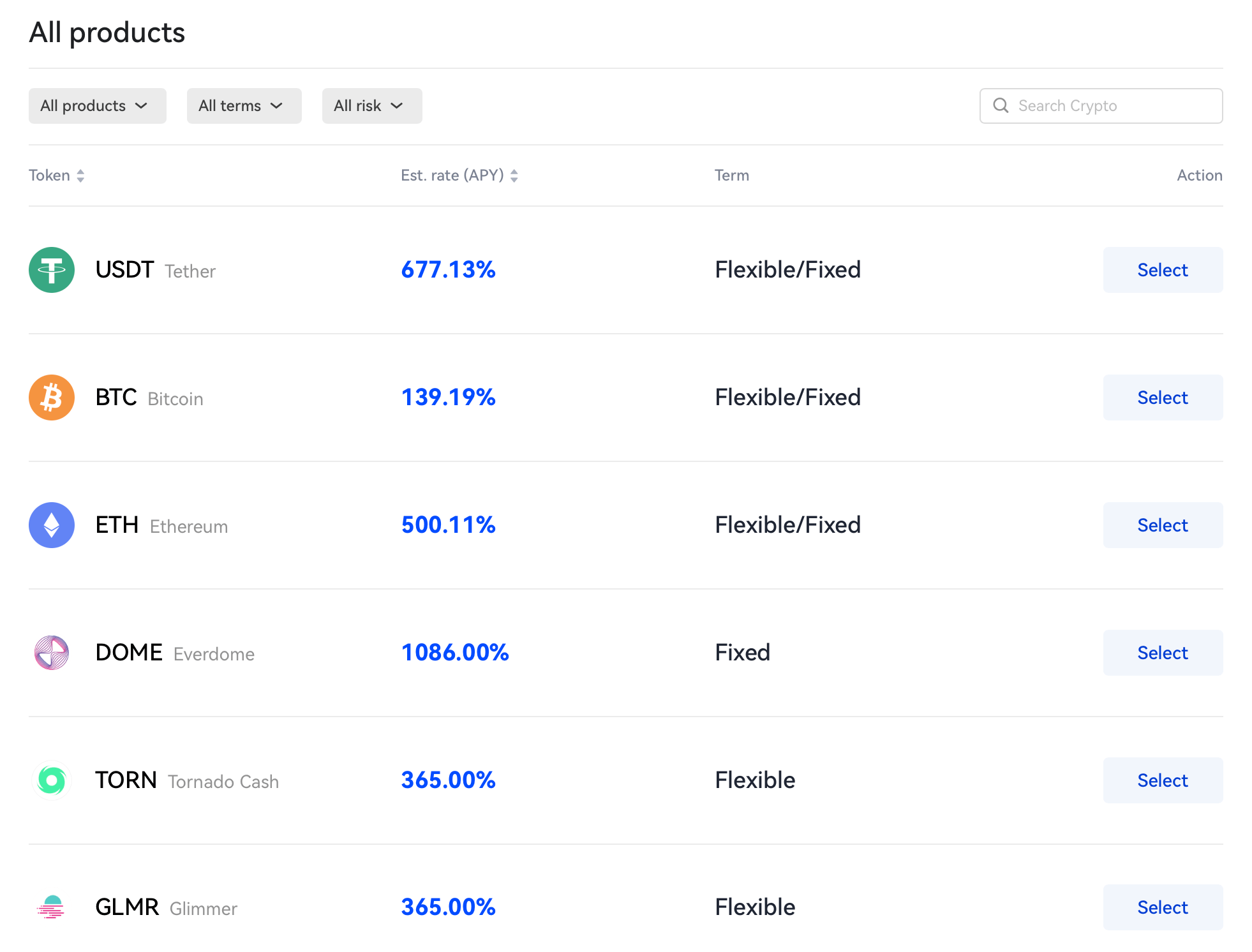

Passive income on OKX

In addition to active trading, the exchange offers passive income options under one of the available programs. Let’s take a closer look at them.

Savings

This is one of the safest options, although the annual interest rate varies within the range of 0.01%-25%. It is possible to replenish and withdraw investment at any convenient time, as the interest is accrued daily.

NOTE! If you made a deposit to your account today, the interest rate on the deposit will be accrued tomorrow. Accordingly, you will be able to withdraw the coins after the expiry of the minimum savings period (one day).

In order to open a savings account, you need to open a corresponding page (Finance – Earn – Savings) and select an asset.

After you click on the asset, you will see information about the accrual of interest and estimated annual interest. You can select the number of tokens and the term of investment.

Staking

Staking at OKX is how Proof of Stake (PoS) networks maintain their security. By locking the native token, you can earn staking rewards in return. One must take into consideration that the timeframe for withdrawal of funds can vary depending on the mechanism of the blockchain that is being used. This income option also carries low risks. However, it is necessary to strictly observe the period of holding the coins, otherwise you will not get the reward.

Also a new project of staking ETH 2.0 is available at the exchange. Users invest traditional Ethereum in BETH tokens (one equals to 0.1 ETH). After the launch of the network, traders can perform reverse conversion and earn their profit. Notably, the new format of staking is rather beneficial. The estimated average return can be 20%; if necessary, users can submit a conversion request and withdraw funds at any time. Developers decided to abolish fixed terms, so now you can invest and withdraw funds at any convenient time.

DeFi liquidity mining

This is an opportunity to invest in centralized credit, exchange and staking services with the objective to increase the level of liquidity of the assets. In this case, you can earn the reward in the token of the project you invested in.

When considering investment, users can review estimated rate, periodicity of payouts and available term of investment.

Crediting users

In this case, a trader can use the OKX Earn service, which allows users to safely and promptly borrow tokens or lend them to other users.

If you decided to become an investor, you need to go to the corresponding page (Finance – Loan) and select the position of the creditor. After that you need to specify the loan amount and the term and the system will automatically calculate your annual profit. It is convenient that you can lend cryptocurrency as well as De-Fi tokens, the term of the loan can reach up to six months, and the estimated yield varies within 3.65% - 15.33% per year.

Account opening on OKX

In order to start investing and trading at OKX, you first need to register on the platform and open an account. Note that there are two steps in this process – filling out the questionnaire and account verification. The entire procedure can take up to 36 hours, depending on the workload of the system.

Residents of which countries can trade at the exchange?

As of now, registration and trading at the exchange is prohibited for citizens and residents of Iran, Cuba, Hong Kong, North Korea, Bangladesh, Syria, Bolivia. All restrictions are related to the imposition of sanctions by the UN or introduced in accordance with the position of the state authorities in relation to digital assets. However, the bans are easily bypassed when using VPN utilities or authorization on the platform from the TOR browser.

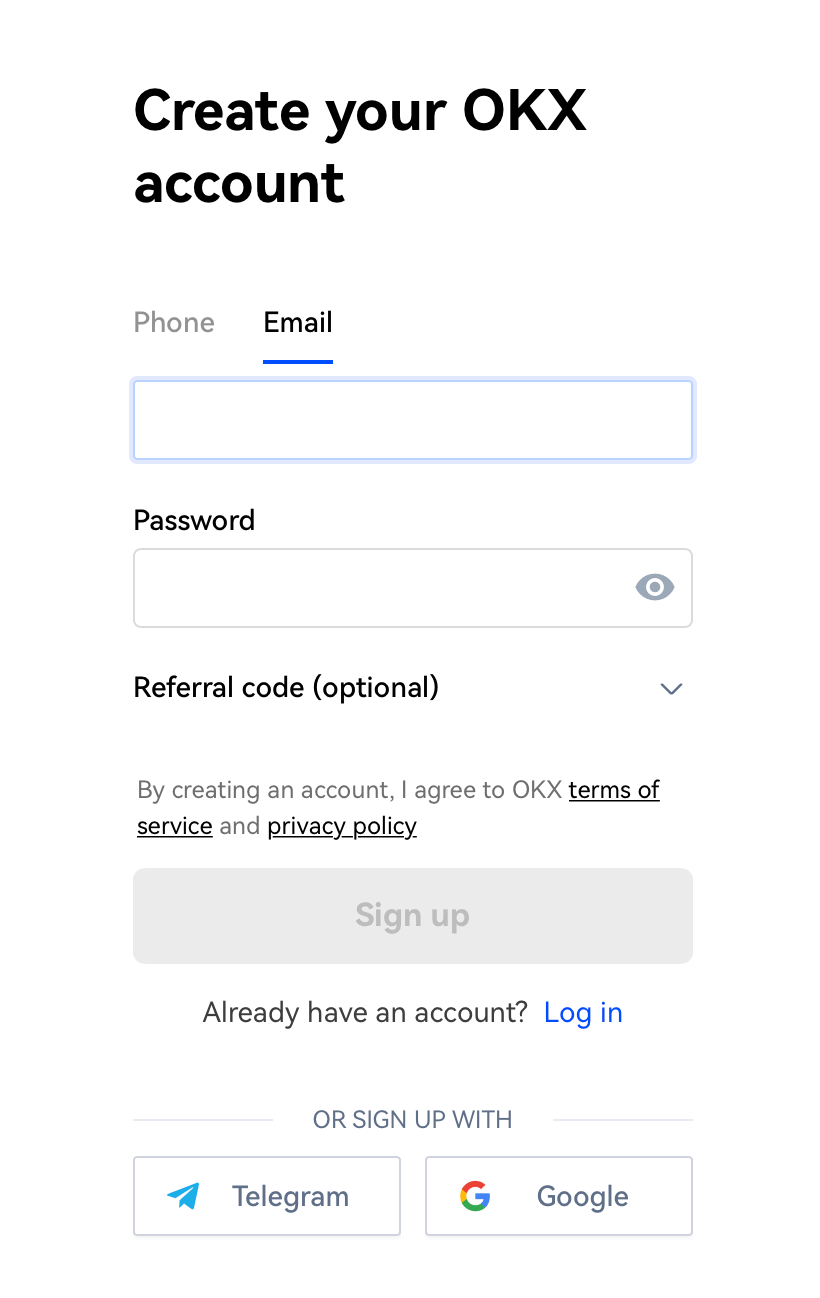

How to open an account on OKX:

a step-by-step guide

The procedure of account opening at the exchange is very simple and clear, although it does differ somewhat from other platforms.

In order to create an account at the exchange, open the official website and click on Sign Up in the top right corner. www.okex.com

In the next window, you need to provide your email and come up with a password. You can also use your Telegram or Google account. If you have been referred, you can also enter the Invite code.

Pass a simple protection against bots. This is usually a captcha, where you are asked to complete a simple action.

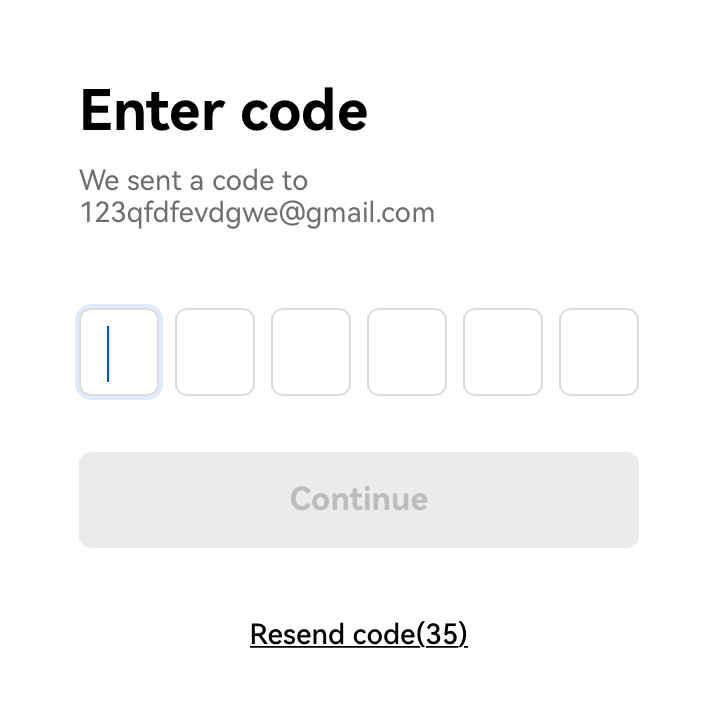

Pass the two-stage check. Depending on the chosen option, it could be an email with a link or a text message with a code.

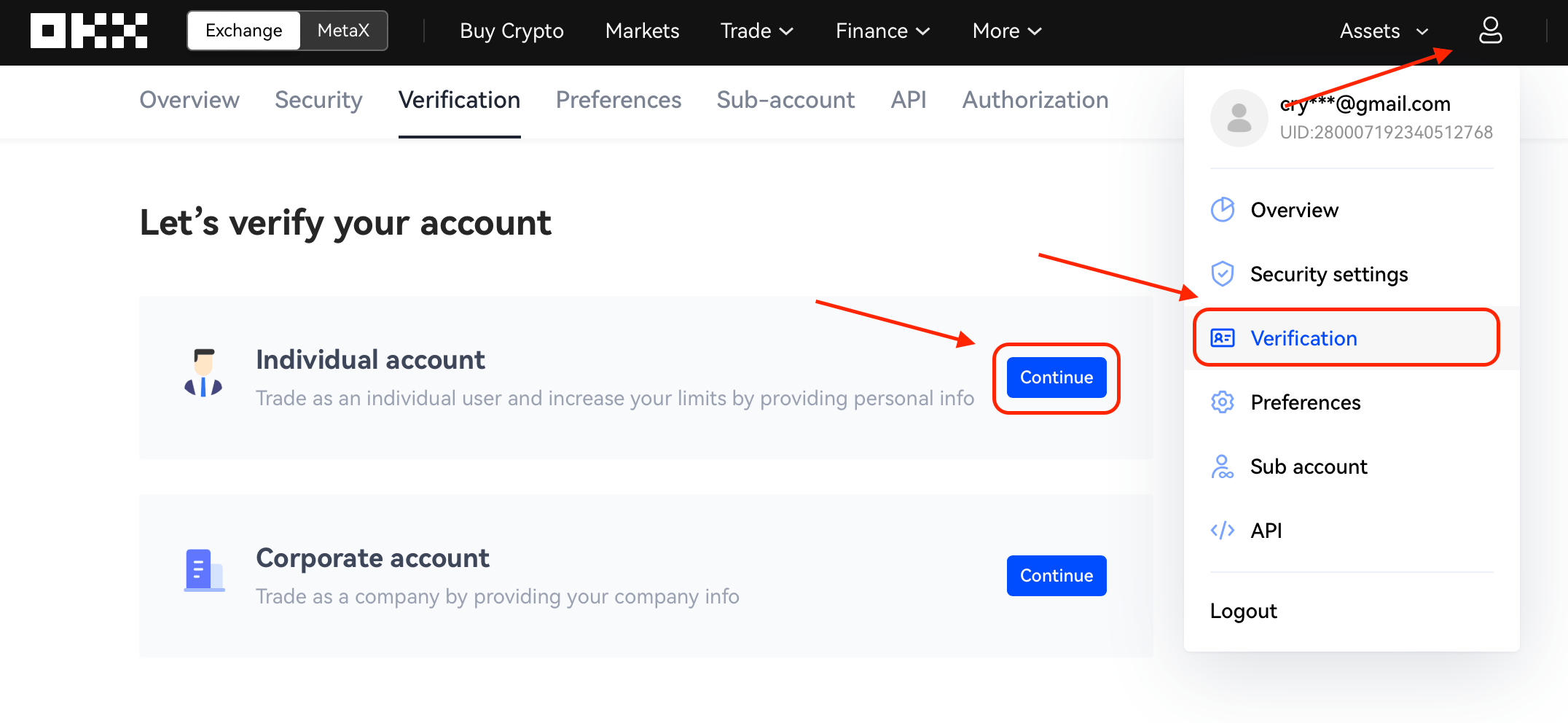

Verification on OKX

Verification is mandatory on the platform. There are two verification tiers at the exchange.

| Tier | Conditions | Limitations |

|---|---|---|

| Not verified | Withdrawal is not possible | |

| Level 1 | 1. Country of citizenship. 2. Full Name. 3. Proof of Identity. 4. ID number. |

Daily withdrawal limit is 200 BTC. |

| Level 2 | 1. Photos/scanned copies of identification documents.

2. Selfie. |

Daily withdrawal limit is 500 BTC. |

In order to pass verification, you need to open your account and go to settings. Then select verification depending on your account type: individual or corporate.

On the page that opens, you will need to provide your full name and additionally attach a scanned copy / photo of the identification document.

After that, you will see information that you’ve been assigned Level 1 of the verification. In order to improve the level of verification, you need to select the Increase Trading Limit tab.

Verification of the second level envisages a photo of the document and a selfie with the document, which must be uploaded to the platform. When you do that, just follow the pop-up instructions.

Account verification on average takes from several hours to three days.

Minimum deposit

There is no minimum deposit on the platform. However, the minimum trade is USD 100 in the cryptocurrency equivalent. Not that the limits may change depending on the chosen asset and the level of trading at the exchange.

| OKX | Binance | HTX (Huobi) | |

|---|---|---|---|

| Minimum deposit | No | $1 (for trading Spot 10) | $1 (for trading Spot 20) |

The platform compares favorably with its competitors, although the $100 limit for the minimum trade creates certain difficulties, as active trading in this case requires some capital.

Account types

Right after the registration, two types of accounts become available to the users: main and trading ones. Also, inside the trading account, there is a division into several accounts by asset categories: for spot, futures, options, etc.

Taking into account that there are separate fees for each type of token, this is rather convenient.

You can transfer funds between accounts at any time and at zero fees.

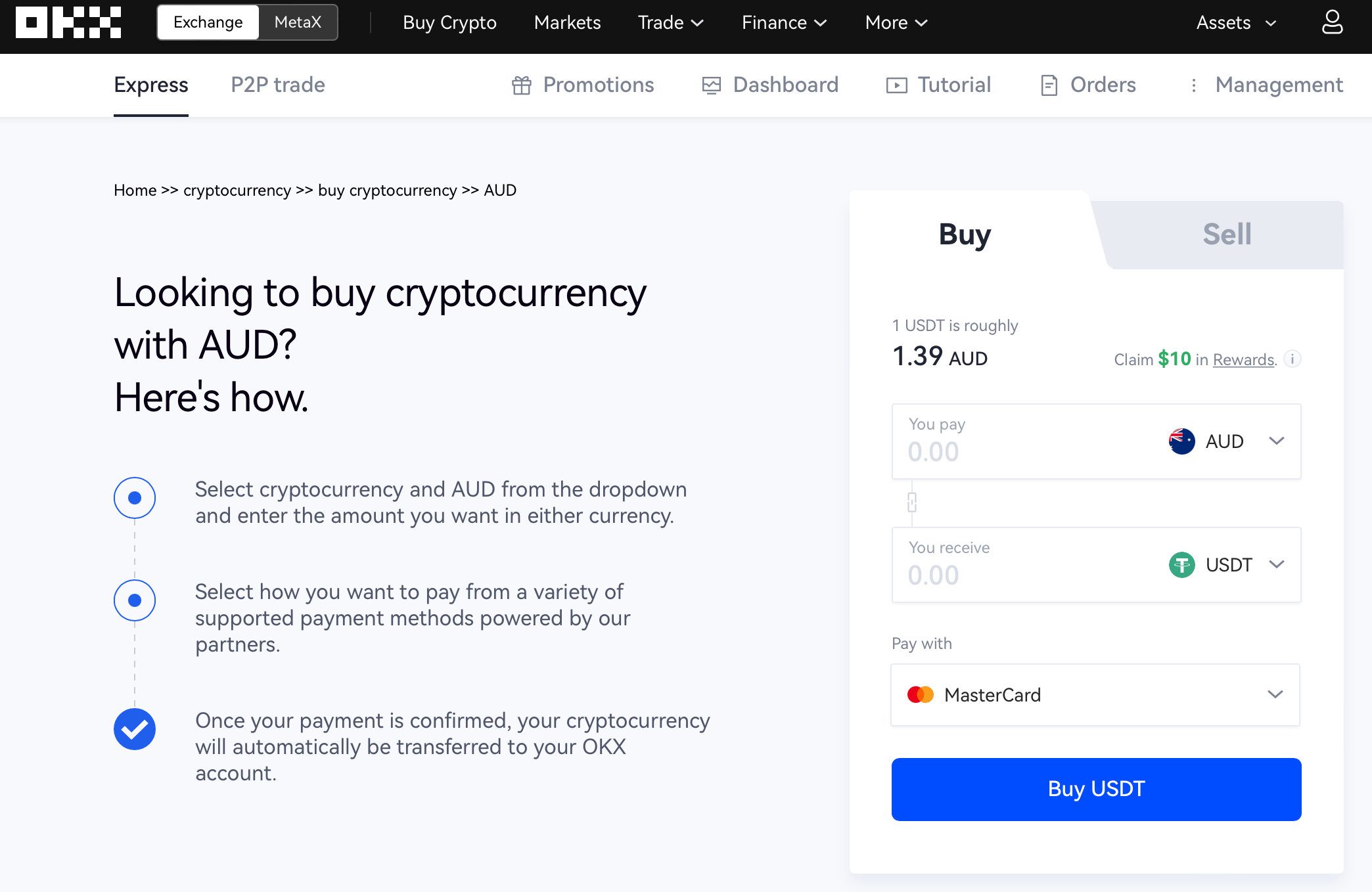

Deposit and withdrawal on OKX

The users of the platform can deposit funds to their accounts with their debit/credit cards, transfer from accounts, and also from crediting of digital assets from wallets. This is quite convenient. You must keep in mind, however, that the deposited funds are automatically converted into the account currency. Transactions with fiat are available only in the p2p trading.

You can buy cryptocurrencies directly for fiat money. Popular global currencies are accepted (RUB, JPY, KRW, VND, IDR, PHP, INR, ARS, SAR, TRY, AED, IQD). The list of supported digital currencies is not long; it includes only BTC, USDT, DOGE, ETH, USDK, LTC and OKB.

You can do it in the corresponding section of the website.

Deposit and withdrawal options and processing time

| Deposit/withdrawal method | Fee | Deposit/Withdrawal processing time |

|---|---|---|

| Bitcoin | No fee on deposits. Blockchain fee on withdrawals. | From several minutes to 4-5 hours depending on the workload of the blockchain. |

| Ethereum | No fee on deposits. Blockchain fee on withdrawals. | From several minutes to 4-5 hours depending on the workload of the blockchain. |

| Debit/credit cards | $2 on deposits + bank’s fee | From several hours to a day (depending on the selected gateway for the transaction). |

Trading platforms

You can trade at the exchange directly from the website or download a mobile application. Let’s take a closer look at the specifics of market analysis and trading from your PC.

In the Trading window, the following blocks are available to the users:

1. Information on the chosen asset (symbol, ticker, current quote, volume, daily high and daily low, etc.);

2. Price chart;

3. Order book or trade history;

4. Order form;

5. Asset trading history.

The platform offers sufficient number of orders for comfortable trading:

- Limit Order, which is closed at the best price.

- Market Order, which is executed immediately with the best offers from the book.

- Stop Limit Order, which is triggered at the worst price.

- Trigger Order, which is closed once the price of an asset reaches a specified value.

- Extended Limit Order, which will be executed once several conditions are met.

The exchange offers two types of charts for analysts – own charts and the TradingView chart, which you can switch between in just a few clicks. Therefore, the traders can study the dynamics of the asset, using the entire range of available instruments.

Comparative table of features

| Web | Mobile | |

|---|---|---|

| Two-factor authentication | + | + |

| Time frame range | + | + |

| Order types | Limit, Market, Stop, Trigger, Extended Limit | Limit, Market, Stop, Trigger, Extended Limit |

| Quote history | + | + |

| Tradingview charts | - | - |

Trading platforms. Comparison with competitors

| OKX | Binance | HTX (Huobi) | |

|---|---|---|---|

| Web platform | Yes | Yes | Yes |

| Android | Yes | Yes | Yes |

| iOS | Yes | Yes | Yes |

| Desktop | No | Yes | Yes |

OKX web platform

The official page of the service is simple and user-friendly. All categories of assets and also trading pages, rules, instruments for technical analysis are well structured on the website. There is also a search box on the home page.

The top menu of the platform features information about the markets, analytics and education sections. At the bottom of the page, there is the contact icon, which also saves time, especially during active trading. The distinguishing feature of the platform is the possibility to open several charts at once and quickly switch between them. Overall, the service is perfect for investing and trading digital assets.

OKX mobile platform

The mobile app of the exchange is well designed and has the same features as the web version. The app is available for Android and IOS.

Analytics

The website features a rather interesting section Industry Analysis with a large number of analytical materials on major events in the world of cryptocurrencies. This format of presenting information allows you to not only learn about important news, but also see how a specific event impacts the dynamics of assets, price fluctuation, and what to expect next.

There is also an entire press center with main market changes and company news. Here, users also can learn about the beginning of a promo offer or other important events.

Education

There is an OKX Academy that is in charge of educating the users. It is a section on the website of the exchange featuring detailed information about the categories of assets, key specifics of tokens and even guides on building trading strategies. Users can also find information on market analysis and a glossary.

Also, users can find information about the operation of the platform in the Support section.

Customer support

The exchange has a big Customer Support center, where you can find answers to your questions.

Users can also contact a chat bot or send a ticker to email. However, the probability of receiving a good response is minimal.

During our analysis of the exchange, we made several requests and asked questions on the website. However, instead of receiving a real response, we got an offer to select a solution from those offered or follow the link to the Support Center.

The center’s page features a lot of information, which is also structured by categories. There is also a search feature. However, you can also search in English, otherwise you get the error message.

Channels of Communication

There are the following ways to contact customer support:

- Email – support@okx.com;

- Support center on the website of the exchange.

You can also call this number +1 226 798 4487, using Twitter, Telegram.

Customer support languages

Despite that the website is available in many languages, the support is only available in English.

Bonuses and promo

The exchange regularly has promos and holds contests. However, at the time when this review was being written, none were found.

There is also a referral program, under which you can invite a friend. The link owner gets $15 to his account in this case after the new user registers.

Another option for earning bonuses is fulfilling simple tasks, which you will receive during the first month after registration.

Summary

The users of OKX have access to a wide range of trading assets. The exchange offers rather good conditions for trading. The undisputed benefits include the selection of trading assets, multilingual interface, availability of required orders and market analysis instruments as well as great passive income options. The exchange also offers some of the best conditions of margin lending.

Nevertheless, you should keep in mind that the platform does not hold an official license for carrying out this type of activity.

Summing up, the service deserves a rather high ranking. Having analyzed the key features of the exchange, we can confidently state that both beginners and experienced traders can work here.