Best Crypto

Exchanges

Here, you will find the ratings of the exchanges based on various categories: crypto exchanges for beginners, regulated exchanges and also the best exchanges of the year.

Choosing a crypto exchange is the same as choosing a reliable partner in the cryptocurrency market. It is essentially a choice of the platform you will trust your month with, where you will hold your assets and trade online. Therefore, it is a serious decision, and in order to make it, you need to do some work analyzing the companies operating in the market, the commissions and fees charged by the exchanges, the assets they provide access to trading, the reviews about them and also other factors.

The rating below is based this kind of analysis to make your choice of the cryptocurrency exchange easier! Every trader will find an exchange in this rating to match his/her demands.

You can also view a comparative table on the exchanges you've chosen. To do this, select the exchanges in the Compare section, click on the button at the top and the information on key indicators and conditions of the exchanges will appear on the screen.

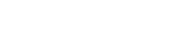

Check out the rating, select the exchange, follow the link, register and trade easily and at a profit!

| Position | Exchange | Rating | Reviews | Vote | Compare | |

|---|---|---|---|---|---|---|

|

|

Rating: 9,4

|

Reviews:

45

Recommended exchange

|

|

|

Exchange Review More | |

Advantages

Bonuses Register right now for a 100 USDT discount! |

||||||

|

|

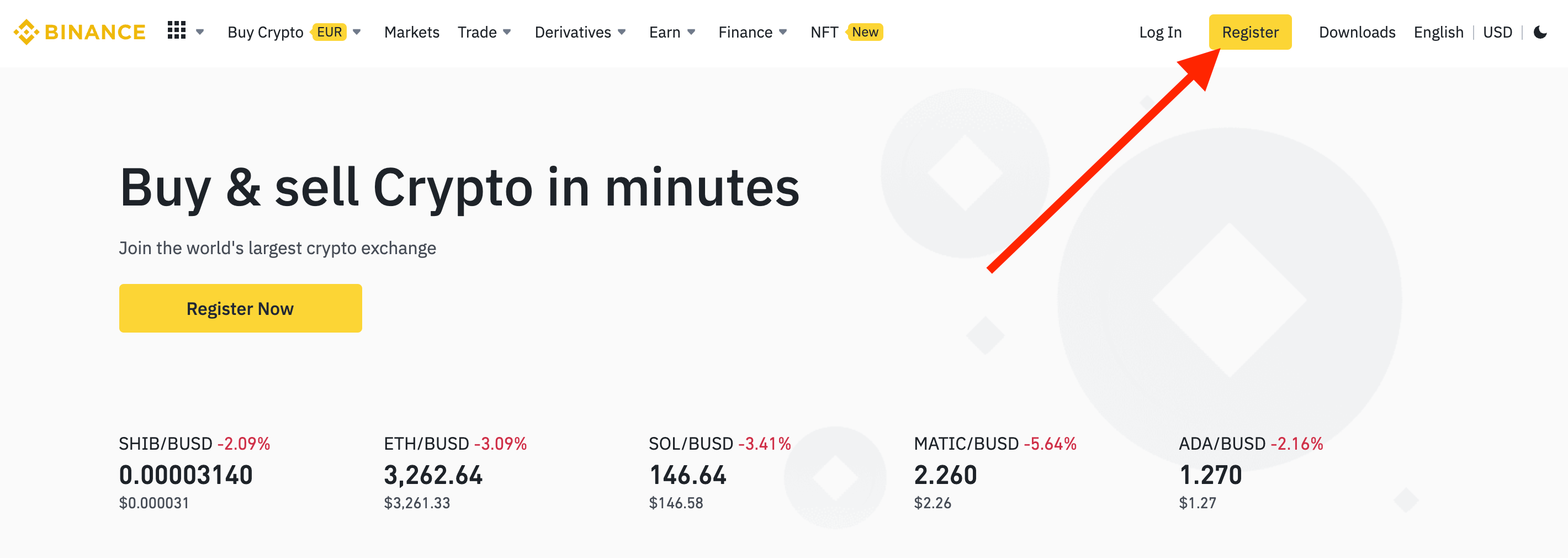

Rating: 9

|

Reviews:

54

|

|

|

Exchange Review More | |

Advantages

Bonuses Register now using our link on HTX to unlock a Mysterious Box containing Cryptocurrency worth up to 1500 USDT in each! |

||||||

|

|

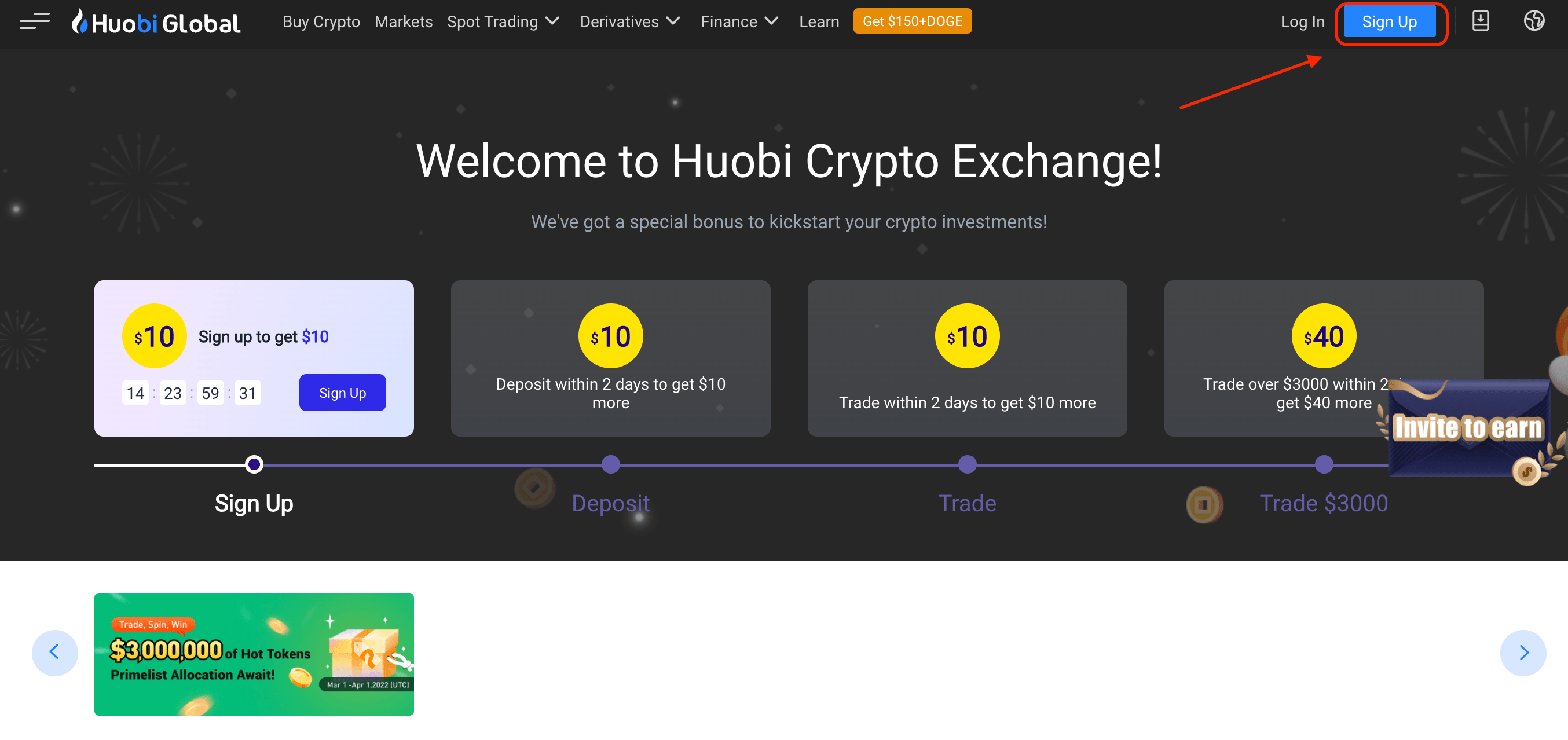

Rating: 9

|

Reviews:

46

Recommended exchange

|

|

|

Exchange Review More | |

Advantages

Bonuses Register by following our link right now and receive a starting reward of 100 USDT. Earn up to 500 USDT in cash rewards and 200 USDT in trading coupons! |

||||||

| 4 |

Rating: 8,9

|

Reviews:

47

Recommended exchange

|

|

|

Exchange Review More | |

Advantages

|

||||||

| 5 |

Rating: 8,5

|

Reviews:

47

|

|

|

Exchange Review More | |

Advantages

|

||||||

| 6 |

Rating: 8,3

|

Reviews:

27

Recommended exchange

|

|

|

Exchange Review More | |

Advantages

Bonuses Receive a bonus of 1000 USDT |

||||||

| 7 |

Rating: 8,1

|

Reviews:

46

|

|

|

Exchange Review More | |

Advantages

Bonuses Register using our link right now, replenish your balance, and participate in the festive draw with a prize pool of 3300 USDT. |

||||||

| 8 |

Rating: 8

|

Reviews:

41

Recommended exchange

|

|

|

Exchange Review More | |

Advantages

Bonuses Register using our link right now, receive a secret prize, and win up to 50 USDT |

||||||

| 9 |

Rating: 7,9

|

Reviews:

30

|

|

|

Exchange Review More | |

Advantages

Bonuses Register using our link right now and get a 10% discount on commissions! |

||||||

| 10 |

Rating: 7,9

|

Reviews:

47

|

|

|

Exchange Review More | |

Advantages

Bonuses Receive exclusive referral rewards and a welcome gift of 5030 USDT |

||||||

Your inquiry has been sent; our manager

will contact you as soon as possible

Your review has been sent; it will appear on the website

after it is screened by a moderator