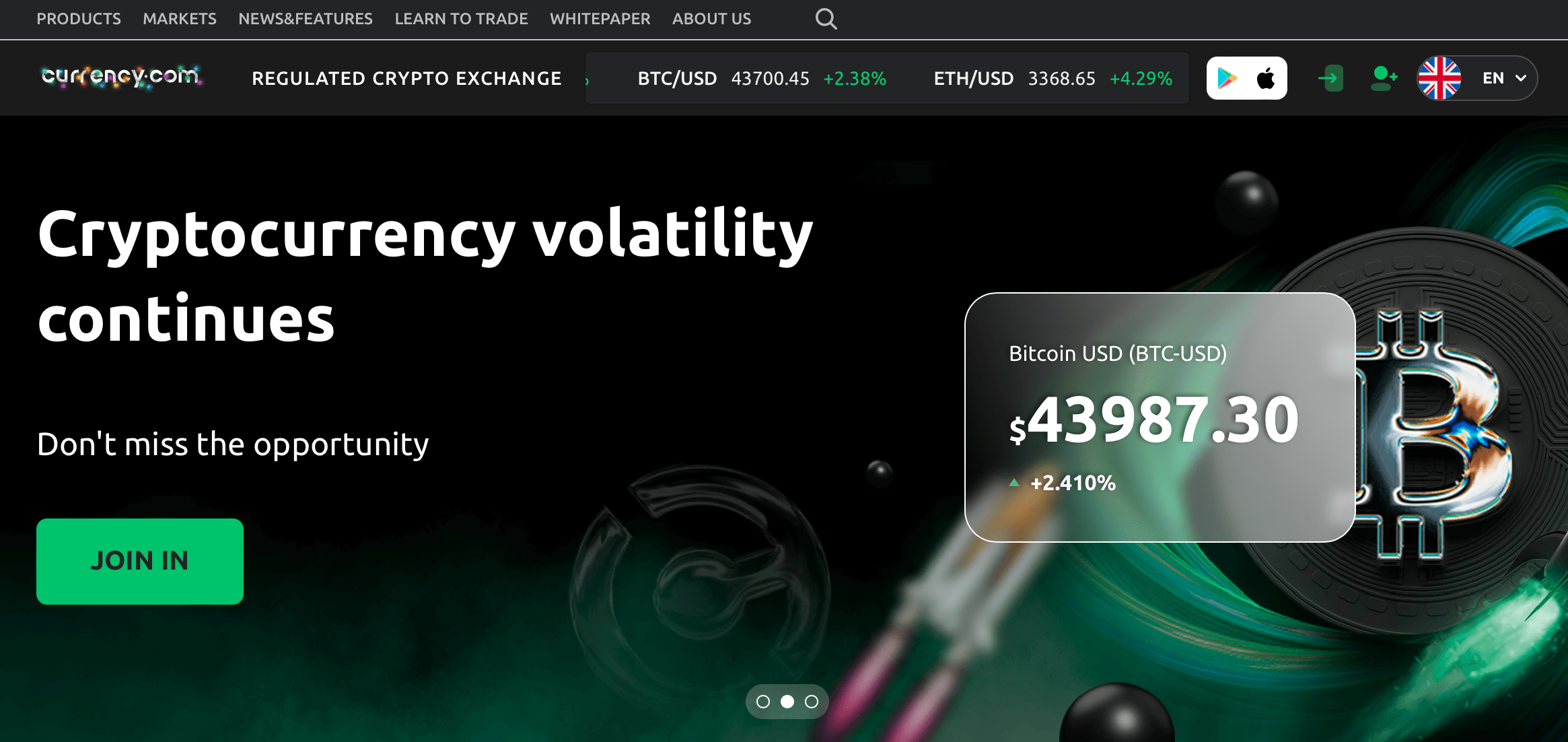

Regulated

crypto exchanges

If you are a supporter of regulation by the government institutions and regard this criterion as a priority, then the information below is for you. The exchanges regulated by the government are considered safer for the users, although in this case you will have to pay an ‘extra price’ in the form of potentially higher commissions and fees.

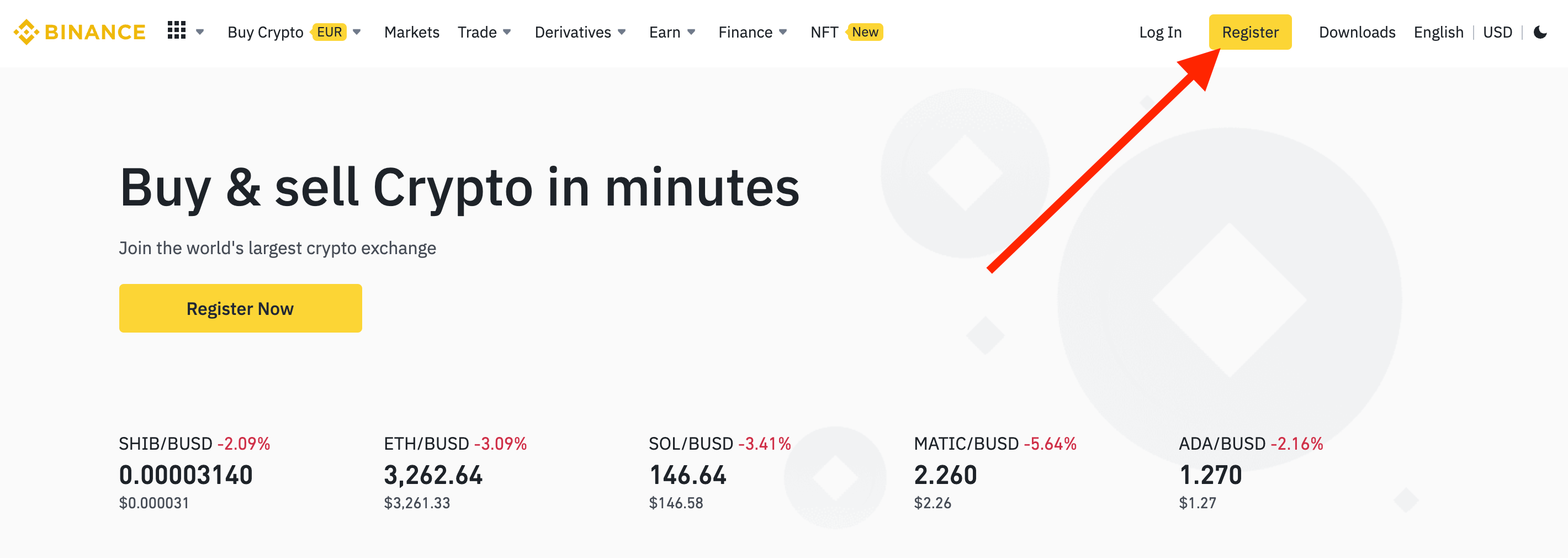

Trading on cryptocurrency exchanges is becoming increasingly popular, but with the growing number of platforms, the question arises: how to choose a reliable crypto exchange? The answer is regulated crypto exchanges. Let's take a closer look at what regulated crypto exchanges are, why they are important, and how they affect your trading. We will also present our ranking of the best regulated crypto exchanges based on a thorough analysis of multiple factors.

What are Regulated Crypto Exchanges?

Regulated crypto exchanges are platforms that operate in accordance with rules and requirements set by government regulators. Unlike unregulated exchanges, they are required to adhere to strict standards of security, transparency, and user protection. Regulated exchanges obtain licenses and are supervised by organizations such as the SEC in the United States or the FCA in the United Kingdom.

A Brief History of Crypto Exchange Regulation

Early Stages of Unregulated Exchanges

In the early days of the cryptocurrency industry, most exchanges operated without any oversight from government agencies. These platforms offered a quick and easy way to buy and sell digital assets but had several significant drawbacks. Due to the lack of regulation, early exchanges often became targets for hackers and scammers. Many users lost their funds as a result of hacks and exit scams. Moreover, unregulated exchanges were not required to comply with anti-money laundering (AML) and know-your-customer (KYC) rules, which attracted participants from the shadow market to these platforms.

One of the most infamous examples of early unregulated exchanges is Mt. Gox. This Japanese exchange started operating in 2010 and quickly became the largest platform for Bitcoin trading. However, in 2014, Mt. Gox was hacked, resulting in the theft of 850,000 BTC. The exchange went bankrupt, and its clients lost their funds. This case became a turning point in the history of the cryptocurrency industry and drew regulators' attention to the need for oversight of crypto exchanges.

Gradual Implementation of Regulation in Different Countries

As cryptocurrencies gained popularity and trading volumes on exchanges increased, governments of various countries started developing regulatory frameworks for the industry. Japan was one of the first countries to introduce licensing for crypto exchanges. In 2017, the Japanese parliament passed a law recognizing cryptocurrencies as legal means of payment and requiring exchanges to obtain licenses from the Financial Services Agency (FSA).

In the United States, the first steps towards regulating crypto exchanges were taken at the state level. In 2015, the New York Department of Financial Services (NYDFS) introduced the BitLicense, which set requirements for cryptocurrency companies operating in the state. At the federal level, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) began overseeing crypto exchanges offering trading in cryptocurrency derivatives.

In the European Union, crypto exchange regulation is carried out under the Fifth Anti-Money Laundering Directive (AMLD5), adopted in 2018. The directive requires cryptocurrency platforms to comply with AML/KYC rules and register with local regulators.

Current State and Future Prospects

Today, more and more countries are implementing cryptocurrency industry regulations and establishing rules for crypto exchanges. However, there is no unified global approach to regulation yet. Some countries, such as Malta, Gibraltar, and Estonia, create favorable conditions for crypto businesses and attract exchanges from around the world. Other countries, like China and India, take a stricter stance and restrict the activities of cryptocurrency platforms.

Despite the differences in regulatory approaches, the general trend is a gradual increase in oversight of crypto exchanges. This is due to the growing recognition of cryptocurrencies as a legitimate asset class and the desire to protect investors' interests. In the future, we can expect further development of the regulatory framework and an increase in the number of regulated crypto exchanges.

Benefits of Trading on Regulated Crypto Exchanges:

1. Enhanced fund security. Regulated exchanges use advanced protection methods and insure user deposits.

2. Compliance with AML and KYC rules. Regulated exchanges conduct thorough customer due diligence to prevent money laundering and terrorism financing.

3. Transaction transparency. Regulated exchanges are required to provide reporting and adhere to information disclosure rules.

4. Protection against market manipulation. Regulated exchanges implement mechanisms to prevent price manipulation and ensure fair trading.

Why Is It Important to Choose Regulated Crypto Exchanges?

1. Safety of your funds. On regulated exchanges, your money and cryptocurrencies are protected, reducing the risk of loss due to hacking or fraud.

2. Stable trading conditions. Regulated exchanges provide a more predictable and reliable trading environment.

3. Trust and reputation. Regulated exchanges undergo rigorous checks and have a good reputation in the crypto community.

4. Fiat currency support. Many regulated exchanges allow buying cryptocurrencies with fiat money, making it easier for beginners to enter the market.

How Does Regulation Affect Cryptocurrency Trading?

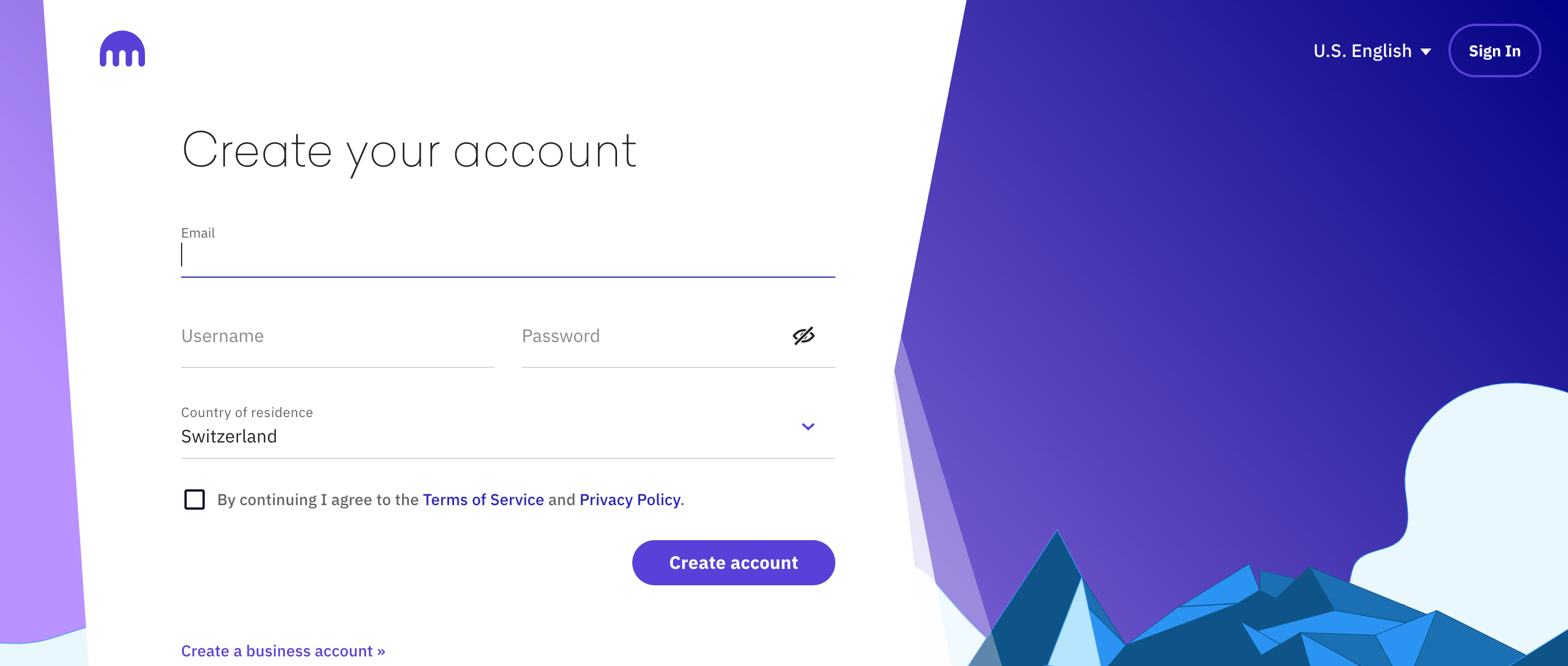

1. User verification. Regulated exchanges require users to go through a KYC procedure, which may take some time.

2. Deposit and withdrawal limits. Regulated exchanges may set restrictions on transaction amounts depending on the user's verification level.

3. Taxation. Regulated exchanges cooperate with tax authorities and may provide information about your transactions.

4. Limited choice of cryptocurrencies. Regulated exchanges usually offer a smaller number of trading pairs compared to unregulated platforms.

How to Choose a Regulated Crypto Exchange?

1. Check if the exchange has a license from a reputable regulator.

2. Read user reviews and research the exchange's reputation in the crypto community.

3. Evaluate security measures such as two-factor authentication, cold storage, and deposit insurance.

4. Ensure that the exchange supports the cryptocurrencies and trading pairs you are interested in.

5. Compare fees and trading conditions on different platforms.

6. Check if customer support is available and how quickly it responds to requests.

Our rating is based on factors such as security, reliability, ease of use, trading features, customer support, and user reviews. We continuously update the information to ensure that our list always includes the best regulated crypto exchanges.

Choosing a regulated crypto exchange is an important step for secure and efficient digital asset trading. Regulated platforms provide a high level of fund protection, stable trading conditions, and compliance with legal requirements. Using our rating and tips for choosing an exchange, you can find a reliable partner for your cryptocurrency trading. Remember that investing in cryptocurrencies involves risks, so always conduct your own research and invest responsibly!