Cryptocurrency Wallets: Types and Usage Features

The first cryptocurrency wallets were developed in 2009. Despite their extensive capabilities, the technology was not sufficiently refined. For instance, users of the first blockchain wallet, Bitcoin Core, had to download the complete blockchain version to access their assets. However, the number of crypto wallets began to grow, and users could choose the most convenient options.

In this article, we will examine the key types of cryptocurrency wallets and the basic rules for selecting an optimal wallet for your cryptocurrency assets.

What Are Crypto Wallets and Why Are They Needed?

Today, cryptocurrency wallets are used by a large number of people. Among the main functions of crypto wallets are storing coins and executing transactions with them (sending and receiving). Some wallets provide more advanced features—for example, the ability to store NFTs (Non-Fungible Tokens), exchange (buy/sell) currencies without using third-party services. However, crypto wallets cannot be called simple asset storage devices, like bank cards, for instance. They involve the presence of public and private keys, through which users can manage basic options:

- public keys are necessary for conducting transactions;

- private keys are for proving ownership rights and gaining access to assets as the owner

It's worth noting that crypto wallets perform their functions differently. All available options are divided into hot and cold wallets. Below, you can familiarize yourself with the main features of these two types.

| Hot Wallets | Online wallets have constant internet access. For this, you can use web browsers, desktop and mobile applications. Internet connectivity is a mandatory requirement. They are presented as separate programs, services, or applications. Often, users choose these wallet options for trading or short-term asset storage, as they are less reliable than cold crypto wallets in terms of security. The advantage is ease of use. |

| Cold Wallets | Offline wallets that operate autonomously and do not require network connection. They can be available as separate devices that connect to PCs or smartphones via USB, Bluetooth, etc., as well as in the format of a paper document with access keys. They are optimal for long-term cryptocurrency storage as they feature a high level of security. They are maximally protected from hacking since hackers cannot access them through the internet. |

The most popular hot wallet is MetaMask. This crypto wallet can rightfully be called the most sought-after worldwide. It is built on the Ethereum blockchain network. Accordingly, its base currency is ether. There is also the possibility of storing and transferring compatible currencies and NFTs. It is used within decentralized applications and DeFi (Decentralized Finance).

Among other popular hot wallets, we can highlight Trust Wallet—a multi-chain wallet supporting more than 60 blockchains , as well as Exodus—an optimal option for beginners with support for more than 200 coins and a cold storage option.

In the top tier among cold wallets, we can mention Ledger Nano S Plus, which allows storing cryptocurrencies and NFT tokens and has access to DeFi and Web 3.0. This is a separate device with the ability to connect to PCs and mobile phones via USB.

SecuX V20 is also popular—a wireless device supporting more than 1,000 cryptocurrencies. A convenient option for beginners is KeepKey, supporting more than 40 coins and tokens.

It's important to consider that hot and cold crypto wallets are divided into numerous subtypes, each with its own specifics. All these features are extremely important to consider when choosing the optimal option for use. Below is detailed information about all popular types of cryptocurrency wallets.

Types of Hot Cryptocurrency Wallets

First, it's worth examining hot online wallets, as they are often popular among beginners and active traders. Within this group, such types as electronic, software (desktop), and mobile crypto wallets are distinguished. Their operating principle is practically identical—users simply need to connect to the internet, go to the required resource, and perform planned actions. However, there are still differences.

Electronic Crypto Wallets or Web Wallets

Such wallets provide the possibility of connection through a browser. You can use both PCs and mobile devices. In the second case, optimized mobile versions of services are often available. Most often, such wallets are presented on crypto exchanges, exchange services, etc.

ОThey can be both centralized (custodial) and decentralized (non-custodial). The former involve control over transaction execution by a central authority (for example, exchange administrators). The latter provide full control over private keys directly to users themselves.

The main advantage of a web wallet lies in ease of use. Users don't need to download additional applications, overloading their PC or mobile device memory. All that's required is entering the needed electronic address in the search bar of the chosen browser. The downside may be access restrictions for residents of various countries. However, thanks to the wide variety of crypto wallets, it won't be difficult to find an available option.

One popular option for such a crypto wallet is Guarda. This is a hybrid wallet—besides being usable online through a browser, users also have access to applications. However, the set of options in each variant is quite impressive.

Software Wallets (Desktop)

These are types of crypto wallets that can be downloaded as applications on PCs. Their advantage can be considered quick launch—users won't need to open a browser, search for the right link, and wait for loading. The downside is the necessity of downloading a separate program that will occupy a certain amount of computer memory. However, users can choose the desktop application that will be optimal for installation.

It's worth noting that software wallets are divided into several subtypes. Simplified versions and full-node versions are available. The former use a separate verified node for conducting transactions. The latter require downloading a complete blockchain copy—these are the most "massive" ones, which is very important to consider when choosing.

You can also immediately choose a wallet that will have both desktop and mobile versions. In this case, it can be used in parallel on different devices. Freewallet is exactly such a wallet, also enjoying high popularity.

Mobile Crypto Wallets

This wallet option for cryptocurrencies will be most convenient for those who like to trade coins and tokens anytime and anywhere. A crypto wallet is a separate application that can be downloaded to a mobile device—tablet or smartphone. Often, such services launch without any restrictions, regardless of the user's location.

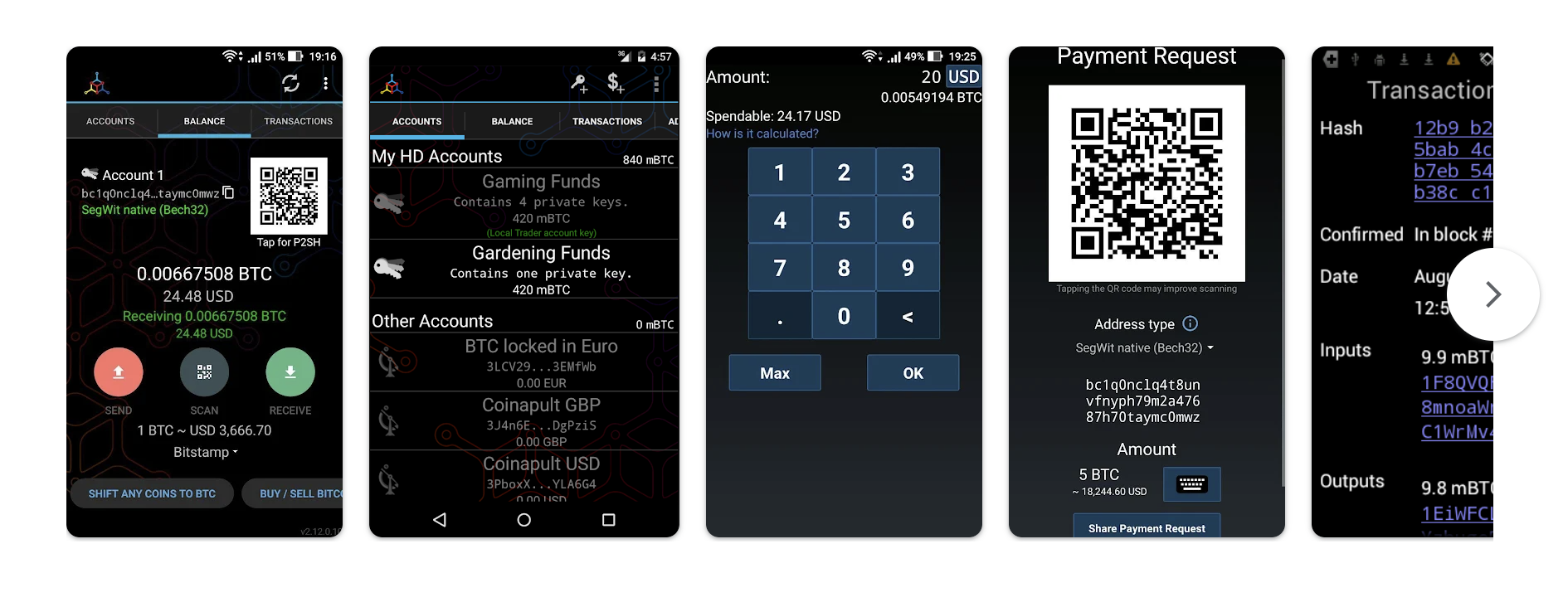

A popular mobile crypto wallet option is Mycelium Wallet. It's available for devices running on the Android operating system.

This wallet is distinguished by a high level of security, as the developers themselves claim. When wanting to select an option available on iOS, you can settle on Trust Wallet.

A common disadvantage of all mentioned types of hot wallets can be considered that they don't guarantee absolute protection from hacker attacks. Access to them is possible from anywhere in the world through the internet, which reduces reliability. But it's worth noting that most popular online wallets use numerous methods to ensure the security of their users' asset storage. For example, this includes two-factor authentication (2FA), allowing clients to control all movements of their funds.

Types of Cold Offline Wallets

Cold crypto wallets are also divided into certain types. The main factors for such classification are the methods of currency storage, as well as how users access the keys to manage the wallet.

The following types are commonly distinguished:

1. Hardware Cryptocurrency Wallets. These are specialized devices used to store crypto assets. They may feature screens to manage wallet functions and vary in their connection to PCs and mobile devices—either via USB cable or wirelessly through Bluetooth or NFC. There are also wallet apps for smartphones, which are essentially software installed like any other mobile application. Examples of hardware wallets include the Trezor Model T, SecuX V20, and others. They often support a large number of cryptocurrencies and tokens. Most importantly, they provide a high level of security.

2. Paper Wallets. A paper wallet is a physical sheet containing public and private keys that give access to your crypto assets. Only with these keys can the user control their funds. The main advantage of paper wallets is their high level of security, as third parties cannot access the user's key. However, the downside is the risk of losing or damaging the paper, which would result in the loss of access to your assets.

3. Brain Wallets. These are somewhat similar to paper wallets, but instead of writing anything down, the user memorizes a seed phrase that serves as the password to access their crypto wallet.

It's important to keep in mind that cold wallets may come with some usage challenges. For example, they may not be convenient for quickly executing transactions, since accessing the assets isn't always as immediate as it is with mobile wallets.

Custodial and Non-Custodial Wallets

There exists another classification of crypto wallets, by which they are divided into custodial and non-custodial. The main difference between them lies in the principle of managing users' private keys. You can familiarize yourself with the main differences in detail in the table below.

| Custodial Wallets | Non-Custodial Wallets |

| User's private keys are under the control of an exchange or other service provider | Private keys are managed directly by the user themselves |

| The service provider bears responsibility for fund safety | The user themselves is responsible for asset safety |

| Optimally suitable for beginners, as they are simple to use and don't require special management skills | Suitable for experienced users who are well familiar with wallet operating principles and management feature specifics |

| Less secure, as the user has no direct control over their assets | More secure—no risk of third-party interference |

| The risk of hacker attacks is higher | The probability of hacker attacks is practically excluded |

| In case of password loss, there's the possibility to restore access | There's no possibility to restore wallet access in case of password or secret phrase loss |

You can notice that each of the mentioned options has both pros and cons. Therefore, when choosing, it's important to consider all features. For example, the custodial wallet Crypterium is suitable for different types of devices, supports a large number of popular cryptocurrencies, and allows purchasing them using bank cards. Thanks to such advantages, it proves especially convenient for beginning traders.

At the same time, the non-custodial wallet Ellipal Titan, being hardware-based, has usage limitations—you can connect to it only through a smartphone. However, this opens access to 40 or more blockchains and more than 10,000 cryptocurrencies and NFT tokens. Also, we repeat, an enhanced level of security for users is guaranteed.

Security of Use and Recovery Methods

Basic information about the security of using various types of cryptocurrency wallets has already been outlined above. Summarizing it, the following key points can be highlighted:

The following options are distinguished:

1. The safest wallets are those to which third parties have no direct access. These are non-custodial crypto wallets. When using them, users independently manage their assets, with no external control involved.

2. A high level of security is typical of offline wallets, since they are not connected to the internet, meaning the risk of hacking is virtually zero (except in cases where the user accidentally or intentionally shares access keys with third parties).

3. Custodial online wallets can also be fairly secure if they are provided by a trusted service provider. It's important that such services offer security measures like mandatory user verification, the option to enable two-factor authentication, etc.

At the same time, it is strongly discouraged to use unverified wallets or those that have been repeatedly subjected to hacker attacks. To avoid this, it’s important not only to read crypto wallet reviews, but also to refer to ratings from reliable sources, user feedback, expert opinions, and so on. Whenever possible, try to get reliable insights from users who have had direct experience with a given crypto wallet.

The issue of cryptocurrency wallet recovery also deserves special attention. Unfortunately, if a user loses access to their wallet’s private key, recovery may not always be possible. In most cases, the only option to restore access is through a backup. However, this backup will only be available if the user enabled the backup option in advance.

Often, you can use a recovery phrase or similar method. For example, MetaMask provides users with 12 random words that must be saved and used to restore access if needed.

A similar approach is used in cold hardware wallets—for example, to recover the configuration of a Ledger Nano S device, you need to use a 24-word recovery phrase. However, if this phrase is also lost, the wallet cannot be restored. This is why it’s strongly recommended to save such data immediately after setting up the wallet—on multiple devices, and even as a printed copy, if possible. However, after doing so, users must be extremely cautious to ensure that the data doesn’t fall into the wrong hands.

It’s also worth noting that even if all data is lost, you can try contacting the wallet service’s support team. If identity verification was completed earlier, there is a high chance that the wallet can be recovered. However, this applies only to custodial wallets. In the case of non-custodial wallets, such recovery is not possible.

Features of Crypto Wallet Selection

No definitive recommendation can be made when choosing a crypto wallet. It's important to consider all the characteristics and features of the available wallets, as well as the specifics of how they will be used.

Special attention should be paid to the following:

1. Security. This directly affects the safety of your assets and the reliability of transactions. It's generally better to choose non-custodial wallets, or custodial wallets provided by trusted and verified exchanges, services, or providers.

2. Compatibility. If you plan to use only one cryptocurrency, a wallet that supports the relevant blockchain will suffice. However, in most cases, multi-chain wallets that support various currencies and tokens are the more practical choice.

3. Simplicity and ease of use. To avoid complications during wallet operation, it's recommended to explore the interface in advance and ensure it's intuitive and user-friendly.

4. Usage goals. If you plan to trade frequently, hot wallets are preferable due to their speed and accessibility. For long-term storage, cold wallets are more suitable thanks to their enhanced security.

If you decide to go with a hardware wallet, you should research the cost of these devices beforehand, as prices can vary widely depending on the model. Keep in mind that this type of device stores not just information, but valuable assets. That’s why it’s essential to verify its specifications, ensure it’s original and high quality, and assess its long-term usability. If you're unsure, consulting with an expert is highly recommended.

In conclusion, the range of available crypto wallets today is quite extensive, which can make the decision overwhelming—especially for beginners. However, by learning the specifics of each type and following trusted recommendations, it becomes much easier to make an informed and optimal choice. The key is to ensure the wallet is truly secure, functional, and convenient to use in alignment with your goals. It's also worth remembering that, despite the wide variety of crypto wallets, only a few consistently remain popular—those that offer the best conditions to their users.