Poloniex Review 2024

Poloniex was established in 2014 by Tristan D’Agosta. For a long time, the cryptocurrency exchange (better known to traders as Polo) was considered a popular platform for altcoins. However, now it is a full-fledged cryptocurrency exchange, offering access to 283 assets that form 435 currency pairs (source: www.coinmarketcap.com ). The exchange offers rather enticing conditions for trading digital coins, which helped it attract a huge number of traders from all around the world.

Poloniex Rating

| Total score | 7,7 |

|---|---|

Commissions

Commissions

|

9 |

Security and regulation

Security and regulation

|

7 |

Markets

Markets

|

9 |

Passive income

Passive income

|

8 |

Account opening

Account opening

|

8 |

Deposit and withdrawal

Deposit and withdrawal

|

8 |

Trading platforms

Trading platforms

|

9 |

Analytics

Analytics

|

8 |

Education

Education

|

6 |

Customer support

Customer support

|

7 |

Bonuses

Bonuses

|

6 |

Poloniex Pros and Cons

Basic information

| Name | Poloniex |

|---|---|

| Website | www.poloniex.com |

| Exchange type | Centralized |

| Regulation | No |

| Taker’s fee | 0.155%-0.1%, depending on 30-day trading volume |

| Maker’s fee | 0.145%-0.02%, depending on 30-day trading volume |

| Demo account | No |

| Minimum deposit | There are minimum deposit requirements only for certain assets (ETC, LSK, NXT) |

| BTC withdrawal limits | Depend on the verification level |

| USD withdrawal limits | Depend on the verification level, however, a USD withdrawal can be requested only in cryptocurrency (USDT), and received in fiat to a bank account/card |

| Withdrawal in Fiat | Trading and withdrawal in fiat are not available on the platform |

| Time frame for account opening | Registration takes around 10 minutes. Verification takes up to 36 hours depending on the congestion of the system |

| Leverage | 2.5x for spot trading and up to 100x – for futures |

| Markets | 435 |

| Passive income options | Staking, margin lending |

| Customer support languages | English, Chinese |

| Withdrawal fee | Calculated individually for each asset |

| Deposit methods | Cryptocurrencies, debit/credit cards, Apple Pay, a bank account at Simple Bank |

| Withdrawal methods | Cryptocurrencies to external wallets debit/credit cards, Apple Pay, a bank account at Simple Bank |

| Account currencies | Popular cryptocurrencies (BTC, ETN, USDT) |

| Promo | Referral program |

Commissions and fees

The exchange has a rather clear system of commissions and fees, with their size decreasing as the 30-day trading volume increases. The fees also depend on the number of tokens held in the account. The exchange also has three categories of users (Silver, Gold and Market Maker), and there are special conditions on payment of fees for them. One of the key features is that a trader pays lower fees if his 30-day trading volume increases. Let’s take a closer look at everything.

Trading fees

Starting from spring 2016, the platform introduced standard fees on transactions of purchase and sale of assets. There is a total of 6 tiers of fees for ordinary users and 2 for the most active traders.

The fee may be reduced as the trading volume increases. The 30-day trading volume is calculated every 24 hours. This allows the service to effectively calculate the fee amount for each user, taking into account the 30-day trading volume. Also, the TRX balance is taken into account.

| Market | 30-day trading volume | TRX Balance | Maker | Taker |

|---|---|---|---|---|

| Spot | Less than $50 000 | Less than $49 | 0.145% | 0.155% |

| Less than $50 000 | More than $49 | 0.115% | 0.125% | |

| $50 000 – $1 000 000 | N/A | 0.105% | 0.12% | |

| $1 000 000 – $10 000 000 | N/A | 0.07% | 0.115% | |

| $10 000 000 – $50 000 000 | N/A | 0.05% | 0.11% | |

| More than $50 000 000 | N/A | 0.02% | 0.1% | |

| Silver | – | 0.0% | 0.06% | |

| Gold | – | 0.0% | 0.04% | |

| Market maker | – | Custom fees are set up for Market Makers | Custom fees are set up for Market Makers | |

| Futures | 0.01% | 0.075% |

There are special fees for Poloniex Silver and Poloniex Gold users (this is a VIP category of traders with high trading volumes). You can be assigned one of the levels by sending an application to the customer support. You will need to submit your application and wait for it to be considered.

Traders are also charged with lower fees when paying with TRX tokens. You can review the fees in detail in the Fees section at the exchange.

Non-trading fees

Non-trading fees include the withdrawal fee. It is a fixed amount calculated individually for each asset. Additionally, the blockchain fee is calculated for the performance of the transaction. The blockchain fee depends on the network congestion and the transaction amount.

The deposit fee is not charged. It is a way to encourage traders and create comfortable conditions for trading at the exchange.

Average commission compared to competitors

| Poloniex | Binance | HTX (Huobi) | |

|---|---|---|---|

| Taker | 0.1% | 0.06% | 0.09% |

| Maker | 0.06% | 0.05% | 0.08% |

One trading plan is available to traders at the exchange, with initial Maker’s fee at 0.145%, Taker’s fee – 0.155%. Taking into account that the fees can be reduced with increased 30-day trading volume, a conclusion can be made that Poloniex offers rather good conditions. Compared to the offers of the competitors, they are at the same level or even better.

Margin lending

Margin lending is available at the exchange. The maximum leverage in the spot is 2.5x. In order to start trading, you need to transfer digital coins to a separate margin account. Note that the initial margin at the trading platform is 40%. This means that in order to get a 10 BTC loan, you need to have at least 4 coins in your account.

In order to open an order with leverage, you need to:

- Specify the price of the chosen position in the Price line;

- Specify the number of coins you’d like to buy in the Amount line.

Next, you need to set the Loan Rate, i.e. the maximum interest rate for the use of borrowed funds. This criterion is set by the trader. If the specified information coincides with the offers provided by the exchange, the trade will be moved to the Loan Demands column (Loading section).

Using margin lending, the users of the exchange can open a long or short position. The first one is used to earn money from the growth of assets. In other words, a trader opens a Long trade. The cryptocurrency is credited to his balance, and when its price increases, he can sell it and earn a profit.

Shorting (short sales) is another very popular method of earning a profit at an exchange. In this case, you open a position only if you expect the price of an asset to drop soon. The assets are purchased from a broker at one price, and the position then closes at a lower price. Then, the borrowed funds are returned, and the trader earns a profit.

Notably, margin lending is available only to users with the second level of verification, both in the spot and futures markets.

Reliability and regulation

The exchange was established in 2014. Initially, this was a project exclusively for the US market. However, within a rather short period of time, the service became popular among traders all around the world. In 2018, Circle, a company where TRON founder Justin Sun is an investor, bought the platform.

In 2019, the management of the exchange announced its exit from the US market. At around the same time, the prohibition to provide services to the US users appeared. At the moment, there is no information about the registration of the legal entity of the company as well as the license in open sources. The operators of the customer support of the exchange claim that the operation is regulated by a special authority in Panama, and the offices of the companies are located all around the world.

In the entire history of the platform, the exchange suffered from several major hacker attacks. The hack in 2017 was particularly successful: the hackers managed to steal around 12.3% of Bitcoins in the user wallets. Right after the incident, the platform introduced continuous audits of the trading process, and increased the security of the servers that serve the clients. Also the method of user data processing was changed. In addition, mandatory verification that was introduced later was also one of the steps to strengthen security.

Interestingly, the exchange fully accepted the liability to compensate for the lost money. This resulted in a short-time increase of the fees. Experts point that the hack could have led to the bankruptcy of the platform. However, to avoid that, a decision was made to freeze 12.3% of user Bitcoins. Thanks to this, the company remained afloat.

Later on, there was a hacker attack in 2018 and the latest DDos attack happened in 2020. However, both attempts to steal user data were prevented.

At the moment, the exchange can be considered comparatively safe. Its level of security is supported by the fact that the latest attempts at hacking the exchange were unsuccessful. The platform uses different methods to protect user accounts:

- Protection against DDos attacks and DNS protocols which is based on a cryptographic signature;

- Several levels of security system that provide protection against the penetration of robots;

- Most user tokens are stored in cold wallets.

The platform also employs two-factor authentication, session journal, confirmation of authorization by email and blocking of IP addresses.

On one hand, Poloniex is a popular service that allows a huge number of users to trade digital assets. It offers a wide selection of tokens, low fees and a possibility to use borrowed funds. On the other hand, the platform does not have a license with any reputable regulator, which means that the service operates outside the traditional financial system (because of that exclusively digital assets are available at the exchange). There are no guarantees of the safety of personal data, but the hacker attacks incidents and quick solution of the issues in the past confirm that the exchange values its clients.

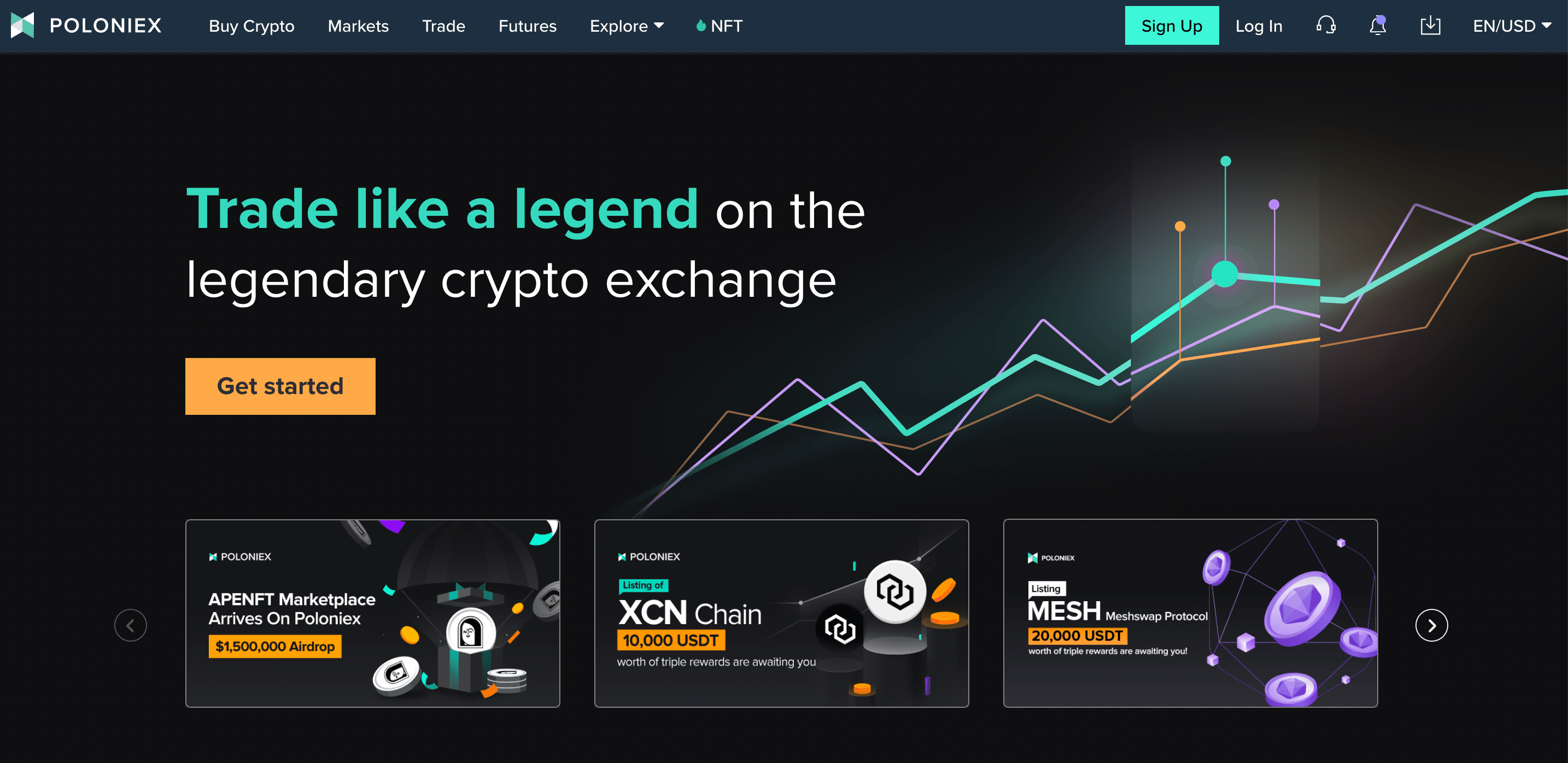

Markets and products

The exchange offers a wide range of various assets, which are conveniently structured by categories: spot, futures, altcoins and De-Fi tokens. A huge number of instruments and assets can ensure comfortable trading. Also, in addition to direct token purchase/sale transactions, traders can use passive income options, which include staking, margin lending and a referral program.

Pros and cons of market diversity on Poloniex

Poloniex markets

| Poloniex | Binance | HTX (Huobi) | |

|---|---|---|---|

| Cryptocurrencies* | 309 | 395 | 584 |

| Trading pairs* | 473 | 1682 | 1135 |

| Bitcoin | Yes | Yes | Yes |

| Etherium | Yes | Yes | Yes |

| Altcoins | Yes | Yes | Yes |

|

Futures and options |

Yes | Yes | Yes |

| Cryptocurrency funds (a basket of cryptocurrencies in one lot) | No | No | No |

| NFT | Yes | Yes | Yes |

Cryptocurrencies (spot)

There are 283 digital assets at the exchange, including the most popular cryptocurrencies and less popular assets. The platform provides access to altcoins and a rather large number of tokens of decentralized finance services (De-Fi). The number of the latter is growing continuously.

The most popular among traders are ELON, FORTH, DEGO, YFI, ADD, API3, REEF and UMA. They are mostly used for the exchange between users without the involvement of a third party, diversification of the trading portfolio and for providing loans to other traders.

The platform also has stablecoins. The most popular one is the asset of the mother company Circle – USD Coin (USDC).

Cryptocurrencies (futures)

In 2020, the exchange launched futures trading. At the moment, traders have access to perpetual BTC and USDT contracts. Notably, there is a fixed trading fee for this category of assets and a leverage of 100x. At the moment, there are contracts on over 20 coins available at the exchange.

Passive income on Poloniex

In addition to direct sales, users can choose from several passive income options. Let’s take a closer look at them.

-

Staking

The exchange offers Cosmos (ATOM), TRON (TRX), BitTorrent (BTT) tokens for staking. This option is available to any registered user. The yield for each staking category is different and is credited daily.

At that, 25% of the payout is deducted as a fee to cover the risks. The earned profit can be withdrawn at any time (without any losses). You can learn more details about this passive income option by contacting customer support of the exchange. -

Margin lending

Margin lending is another way to earn passive income. If you have tokens in your account, which you don’t plan to use soon, you can lend them and earn additional income.

You decide on the interest rate at which you are prepared to provide funds to other users. Note that at the stage of formation of the offer, you specify the highest rate. After that the offer is moved to the field of view of potential borrowers. During periods of particularly active trading, it is possible to issue several loans at once during the day.

However, do not forget that the exchange will charge a fee in the amount of 15% of the funds earned by financing other users. At the moment, margin lending is available for 16 digital coins, but soon the selection is expected to grow.

Account opening on Poloniex

In order to start trading at Poloniex, you need to register and pass verification. Overall, it may take up to 36 hours provided that you’ve observed all the rules and recommendations and depending on the system congestion.

Account opening on Poloniex

Residents of which countries can trade at the exchange

Registration and trading spot assets at the exchange is currently prohibited to the citizens and residents of Crimea, Cuba, Iraq, Iran, Libya, North Korea, Sudan, and Syria. Also, any activity on the platform is prohibited for residents of mainland China, the USA and US territories (such as the Virgin Islands, Northern Mariana Islands and Guam).

Trading perpetual contracts (futures) is not available for citizens and residents of Belarus, Burma, Mali, Somalia, Zimbabwe.

If during registration, you receive a notification that you cannot trade on the platform, although you are living in an ‘allowed’ country, you need to contact customer support of the exchange by email. Verification will be performed manually.

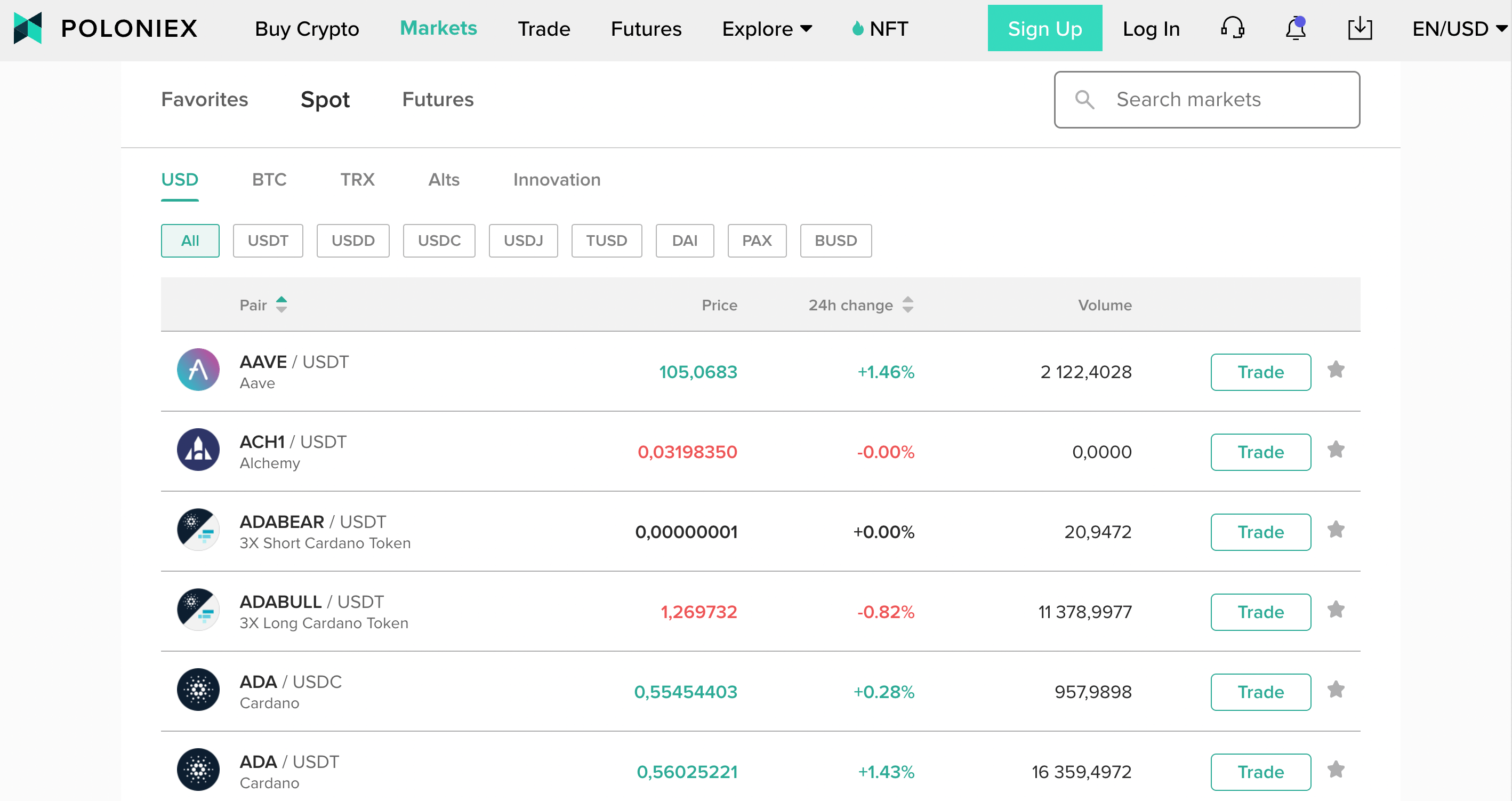

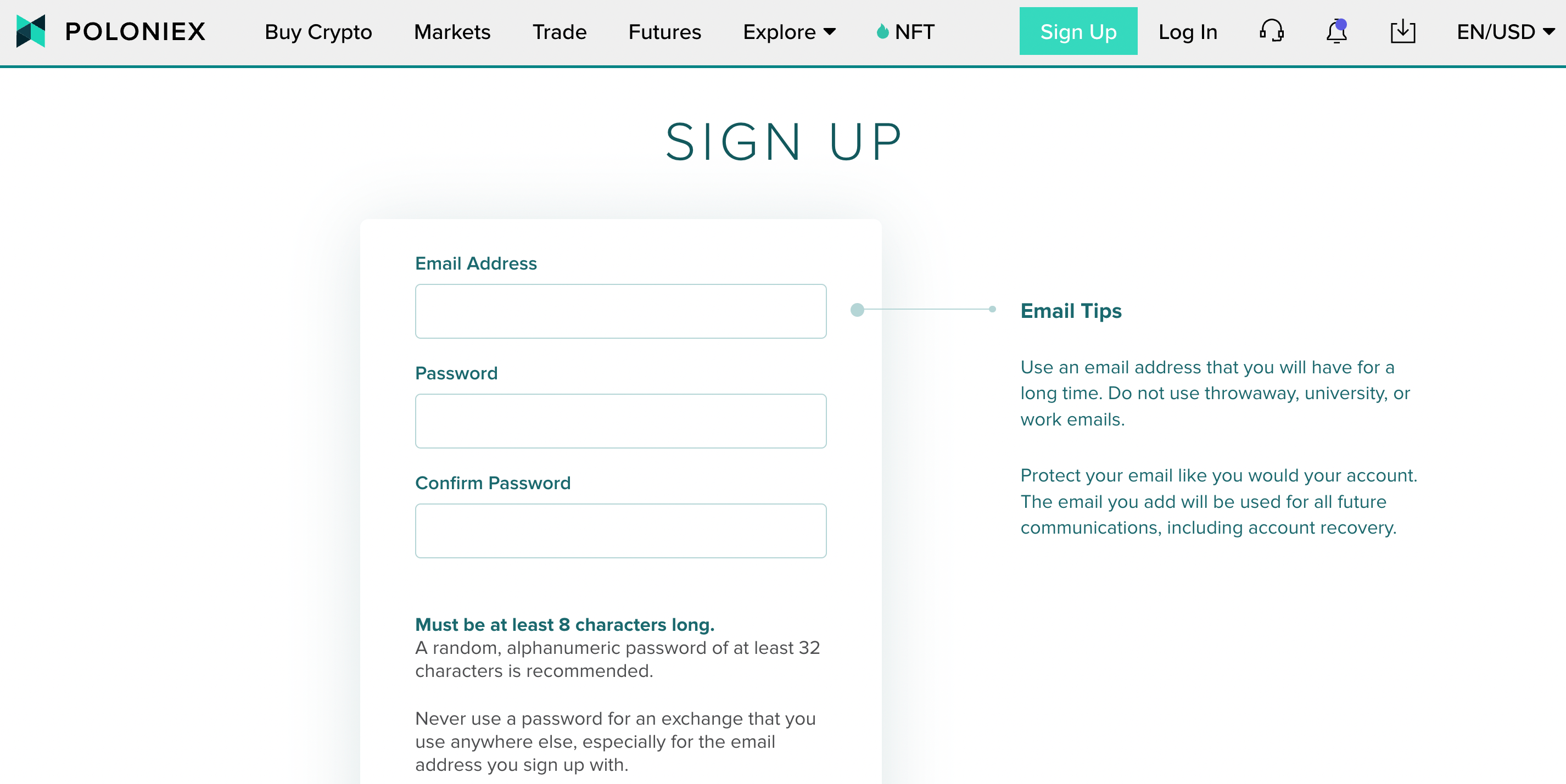

How to open an account on Poloniex:

a step-by-step guide

There are no special requirements for the registration; the procedure is very similar to the way you register on other exchanges. Let’s take a closer look at it.

First, open the homepage of the exchange and select your preferred language in the top right corner, then click Sign Up. www.poloniex.com

Next, fill out the form, providing your first name, last name, country, date of birth and your email. Next, come up with a password (at least 8 characters). It is recommended that you choose a combination of numbers, letters and signs. This way, the account password will be strong and reliable.

Check the information you’ve entered, confirm that you are not a robot and click Sign Up.

Once you’ve completed the previous steps, you will receive a letter with a link to your email. This is required for your email verification. Follow the link and you will access your Personal Account.

At this stage, the creation of a new account is completed.

Next, we recommend that you fill out a user profile, specify the city of residence (with the postcode and address) and also your phone number.

The interface of the Personal Account is rather simple, but has all required features and sections.

Verification procedure

When the exchange first appeared in the market, the personal verification procedure was optional; it was required only if a user wanted to withdraw more than USD 2,000 per day from the account. However, after multiple hacker attacks, the management of the exchange decided to make verification a mandatory step for user registration. Since May 2018, every user must pass KYC before starting to trade at the exchange.

Users, who were registered before that date, also had to pass verification using a special internal form; otherwise, a trader received a warning and then user accounts were frozen and personal accounts were blocked.

The exchange has two levels of verification. The first level of verification is available right after confirmation of the email.

In order to pass verification of 2 level, you need to take the following steps:

- Go to your Personal Account and select the corresponding section;

- In the questionnaire, provide your country of residence;

- Attach a high-quality photo or a scanned copy of the identity documents (it can be a passport, foreign passport, driver’s license);

- Upload a photo holding the document in your hand (it is important that your face is visible).

There are pop-up prompts to help you with the entire procedure. After you’ve uploaded the files, you need to click Save. Your data will be sent for processing. Verification takes from 2-3 to 36 hours. Afterwards, you receive a notification confirming that you’ve successfully passed verification. In case of any issues, the system will request additional documents for proof of identity. This, however, happens extremely rarely.

We compiled a table to show the key differences between the verification levels.

| Level 1 | Level 2 | |

|---|---|---|

| Spot trading | Unlimited | Unlimited |

| Futures trading | Unlimited | Unlimited |

| Deposits | Unlimited | Unlimited |

| Withdrawal limits | $10,000 (in cryptocurrency equivalent) | $500,000 (in cryptocurrency equivalent) |

| Withdrawal limits after passing 2FA | $500,000 (in cryptocurrency equivalent) | $1,000,000 (in cryptocurrency equivalent) |

| Margin trading | - | + |

| Manual password reset | - | + |

| Access recovery through 2FA | - | + |

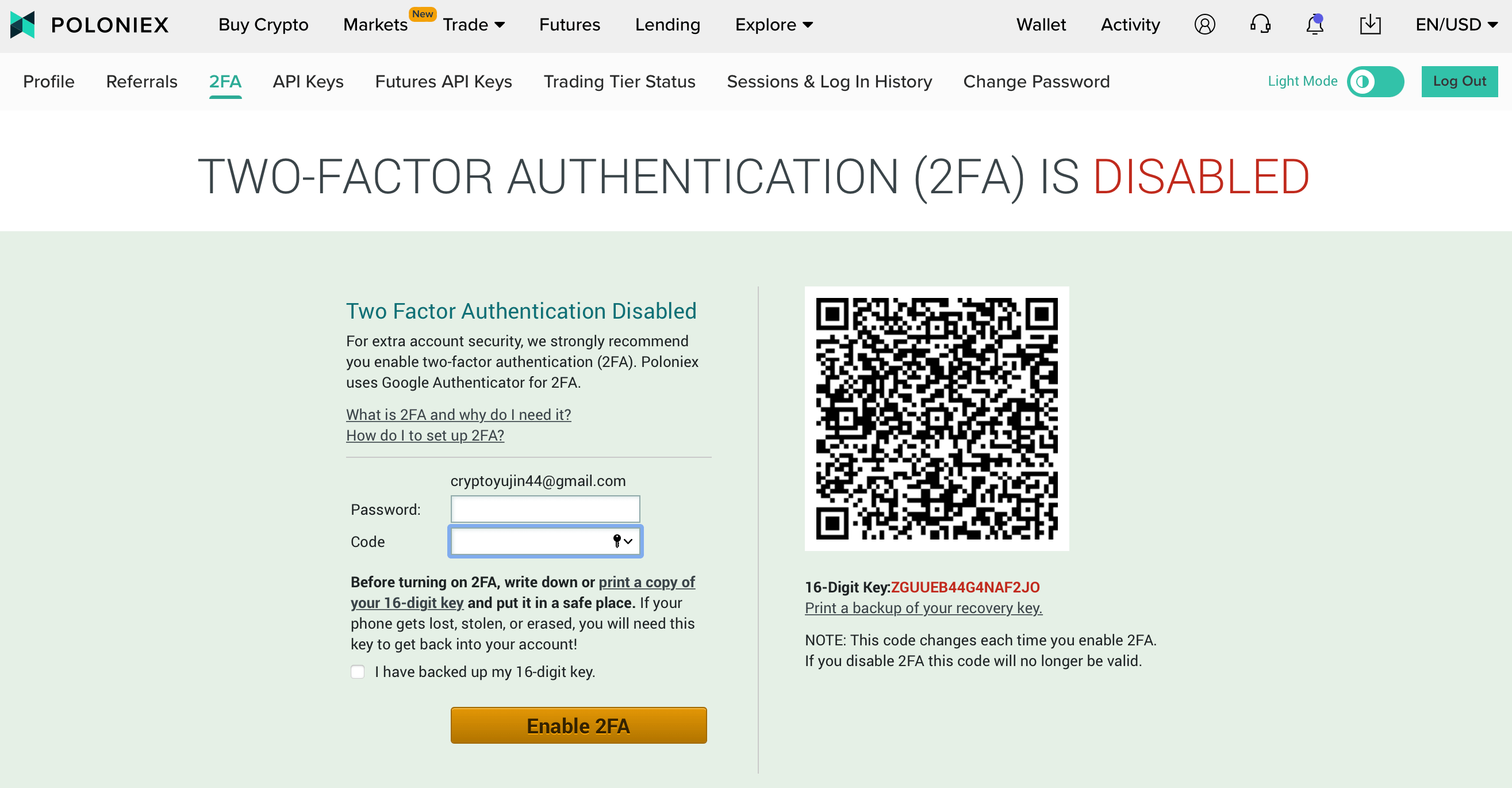

Two-factor authentication

To maximize the security of user accounts, the exchange offers you to pass two-factor authentication. This involves logging into your account with your Google account or API key. You can activate this feature in your personal account, in the TWO-FACTOR AUTHENTICATION tab (it is shown as ‘disabled’ immediately after registration).

Minimum deposit

| Poloniex | Binance | HTX (Huobi) | |

|---|---|---|---|

| Minimum deposit | No | $1 (for trading Spot 10) | $1 (for trading Spot 20) |

Account types

There is only one trading account that opens right after registration. However, there are several wallets for convenience – for trading, margin lending, and staking.

This allows you to quickly distribute funds and not get confused when making transactions.

Deposit and withdrawal

Users of the platform can make deposits with debit/credit cards, separate accounts with a transfer and also through crediting digital assets from wallets. This is rather convenient.

Taking into account that there are no fiat transactions on the platform, when a deposit is made, the funds are immediately converted into the chosen cryptocurrency and credited as digital coins to the account. The same mechanism is used for withdrawals – a user registers a request in cryptocurrency, and gets fiat money to his bank account.

Deposit and withdrawal options and processing time

| Deposit/withdrawal method | Fee | Deposit/withdrawal processing time |

|---|---|---|

| Bitcoin | There is no deposit fee; withdrawal fee is calculated when the request is submitted | From several minutes to 2-3 hours depending on the system congestion |

| Ethereum | There is no deposit fee; withdrawal fee is calculated when the request is submitted | From several minutes to 2-3 hours depending on the system congestion |

| Debit/credit cards, accounts | There is no deposit fee; withdrawal fee is calculated when the request is submitted + the fee for conversion of the asset into fiat and back. Also the bank may charge a fee for transfer (for deposits) | From several minutes to 2-3 hours depending on the system congestion and specifics of the bank of the recipient |

Trading platforms

You can trade at the exchange directly from the website or by downloading the platform’s mobile app. Both options offer users a rather convenient service with a full range of required instruments.

Pros and cons

The cryptocurrency exchange has a convenient interface, where all features are ‘in the right places’. It may seem a bit difficult to novice traders, but the platform is generally very good. Another advantage is that the mobile version uses similar features and the chart is built on TradingView. Therefore, you can set it up using the most comfortable indicators or other market analysis tools.

Below the chart are placement windows for orders (buy, limit and sell). The Trollbox Poloniex can be opened on the side. It is essentially a general chat where you can communicate with other traders while trading.

At the moment, traders can use the following orders:

- Buy.

- Sell.

- Stop Limit.

At first glance, it may seem that it is not enough. However, these are the key instruments that can provide you with comfortable trading provided you use them right.

Also, in the course of trading, information about orders is available to users. You need to access the ORDERS menu. It has two sections. The first one is the orders and the second is the history of buy/sell orders for a certain period of time (usually for the last few hours).

The Stop Limit order is another advantage of the exchange. Thanks to this order, traders can protect their position, without risking losing the entire deposit at once.

Comparative table of features

| Web | Mobile | |

|---|---|---|

| Two-factor authentication | + | + |

| Order types | Buy, Sell, Stop Limit | Buy, Sell, Stop Limit |

| Quote history | + | + |

| Tradingview charts | + | + |

Trading platforms. Comparison with competitors

| Poloniex | Binance | HTX (Huobi) | |

|---|---|---|---|

| Web | Yes | Yes | Yes |

| Android | Yes | Yes | Yes |

| iOS | Yes | Yes | Yes |

| Desktop | No | Yes | Yes |

Web platform of Poloniex

The official website of the exchange is simple and user-friendly. The top panel has all main sections. The instruments for market analysis and placement of orders are conveniently placed throughout the platform.

The footer of the website features the list of main sections, where a user can learn about the commissions and fees, visit the support page or open the company’s blog.

Mobile platform of Poloniex

Despite the fact that the web interface of the platform is adapted for mobile devices, it is easier to work through the app. The application of the exchange is available for Android and iOS devices.

The latest version of the app fully repeats the set of features of the website. Therefore, you can monitor the market and buy and sell without using your PC.

Notably, in order to trade through the app, you will need to generate an API key in the browser. This is a mandatory condition that provides additional security for your account.

Analytics

There is a link to the blog of the cryptocurrency exchange on the website. The blog features a huge number of interesting, and most importantly, informative materials about the latest market trends, as well as latest news. Thanks to the convenient heading and filter system (on the Archive page), you can quickly find the required information and review it. There is also a Search bar.

Overall, the blog is a kind of symbiosis of analytical educational materials and a news digest. New materials are published regularly to keep you up to date on the events.

Education

There is no dedicated educational platform at the exchange. However, there is a rather extensive Poloniex Support section featuring a huge number of guides on how to use the platform.

Educational materials are also featured in the blog.

If you have any questions while trading, you can contact customer support and receive a link to the response and specific information.

Customer support

The exchange has a big support center, where you can find answers to your questions.

Users can also contact a chat bot or send a ticket to an email.

When we were writing this review, we made several requests to the customer support and received answers to practically all of them. It is rather convenient that you can form a ticket with the question directly on the trading platform, through the chat bot. The response will appear in the corresponding window and will also be sent to your email. If necessary, you can review the response once again in your mail.

Communication channels

There are several ways to contact customer support:

- Ticket support.

- Trollbox (by addressing the administrator of the chat).

- Chat bot.

- Email – support@poloniex.com

Support by phone is currently unavailable.

Customer support languages

Customer support is available in English. However, you can choose a language (English, Chinese or Russian) on the support page to review the information.

The responses to tickets sent to your email are in English, while the correspondence in the chat bot automatically switches to the user's language. This means that if the question was asked in Italian, the response will also be translated into Italian.

Bonuses and promo

The exchange offers a Referral program. Under its conditions, a user who signed up on the platform using a referral code will get a 10% trading fee rebate. At the same time, the ‘owner’ of the referral code will receive 20% of the trading fees paid by the new user. The referral program is valid for 18- days or until the user account balance reaches USD 5,000.

Summary

Poloniex cryptocurrency exchange survived the difficult period of hacker attacks and user data theft almost right after it was established. Nonetheless, the management of the platform managed to quickly fix all issues and create a safe space for trading cryptocurrencies. Today, traders from all around the world use the platform.

Definite advantages of the exchange include low fees, wide selection of assets and user-friendly trading platform. A simple interface makes the service popular among novice traders, who are making their first steps in the digital asset market. Active traders, however, need to take into consideration that the second-level instruments on this exchange have low liquidity. If you want to trade such coins actively, it is better to choose an exchange among the leaders by trading volumes.

The service might not have a centralized license for this type of activity, but the platform has an internal regulation and several levels of security in place.

Summing up, the service can be rightly given a score above average. Having analyzed the main aspects, one can say that both beginners and experienced traders can work with this exchange.